Feb 26, 2021

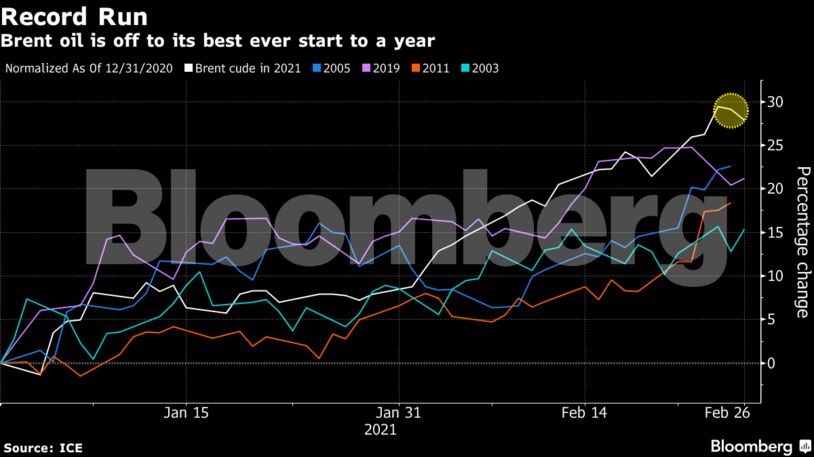

Brent in London fell at the end of a week that saw the steepest decline in the Nasdaq 100 since the pandemic meltdown. Yet the global benchmark crude has had its best ever start to a year as supplies tighten and pockets of demand return. Next week, the Organization of Petroleum Exporting Countries and its allies meet to decide on output levels, with market gauges indicating strength.

The demand outlook has improved, with traders and investment banks this week making a series of bullish calls and upward price revisions. The recent big freeze that halted millions of barrels of U.S. output has exacerbated the tightening, and supply scarcity may worsen in the coming months as North Sea fields undergo major maintenance.

Meanwhile, the market is facing an escalation in Middle East tensions after the U.S. carried out airstrikes in Syria on sites connected to Iran-backed groups.

“No doubt the crude oil market is undersupplied and tight,” said Helge Andre Martinsen, an oil analyst at DNB Bank ASA. But given this week’s bond-market selloff, “the macro and liquidity trends are so strong and dominating that a shift will clearly impact all markets, including oil.”

| Prices |

|---|

|

Soaring bond yields on Thursday were the latest sign that accelerating inflation could trigger a pullback in monetary policy support that has helped fuel gains in risky assets during the pandemic. It could have ripple effects across commodity markets.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire