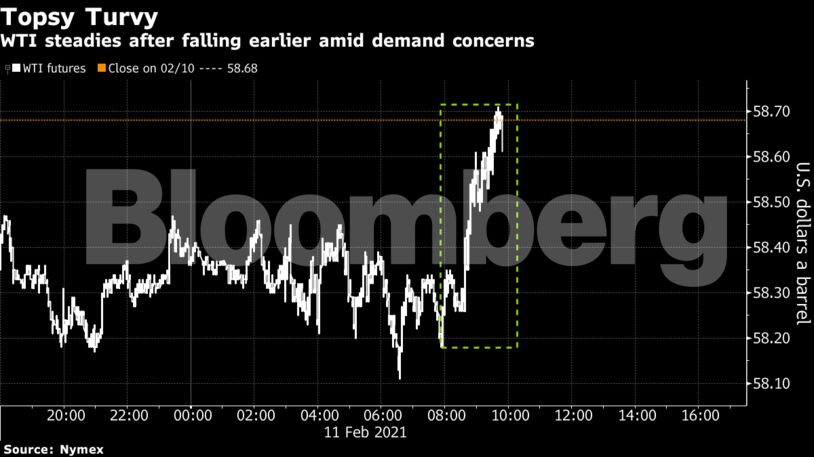

Futures in New York earlier dropped as much as 1% on Thursday. Equities strengthened as a decline in initial jobless claims showed a somewhat stronger labor market, while a weaker U.S. dollar also boosted the appeal of commodities priced in the currency.

The IEA said the re-balancing of the global oil markets remains fragile and cut its forecasts for world oil consumption in 2021 as the pandemic continues to limit travel and economic activity. Still, the market’s prospects look stronger in the second half of the year and swollen oil inventories will drop sharply as fuel use picks up.

While crude is up more than 12% this month, the recent stretch of price gains has pushed its 14-day Relative Strength Index this week to the most overbought level in more than 20 years, signaling a correction is due. Meanwhile, Citigroup Inc. predicted the global benchmark Brent will reach $70 a barrel by the end of the year and JPMorgan Chase & Co. called a new supercycle for commodities.

Oil’s rebound accelerated after Saudi Arabia pledged to deepen output cuts and as prompt timespreads firmed in a bullish backwardation structure, helping to unwind global stockpiles built up during the outbreak. There are still concerns that the virus may curb near-term fuel demand, with China’s air traffic falling sharply ahead of the Lunar New Year holiday after a resurgence in some areas.

“OPEC+’s extraordinary supply management remains the overwhelming force behind the tighter balances, but Saudi Arabia’s voluntary unilateral 1 million barrel per day cuts will likely end after March,” TD Securities commodities strategists including Bart Melek said in a note. “The risk is that OPEC+ discipline and compliance may soon be peaking, as the higher price environment incentivizes nations to unwind the excess capacity into the market in just a few months.”

| Prices |

|---|

|

Along with the IEA’s expectation for a brighter second half of the year, OPEC also said demand for its crude will be higher than previously expected, on a weaker outlook for rival supply and stronger global consumption in the second half.

“We’re seeing that the outlook for the economy and oil demand in 2021 is looking brighter, despite the near-term weakness because of coronavirus,” Toril Bosoni, head of the oil market division at the IEA said in a Bloomberg TV interview. “We still have to reduce the overhang on the product stocks that built up.”

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet