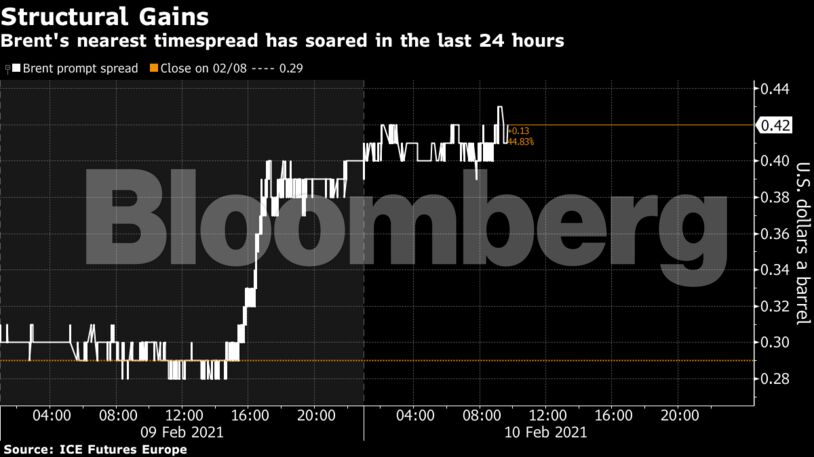

By Saket Sundria and Alex Longley Some of the biggest moves in the past day have come at the front of the futures curve. Brent’s nearest timespread has surged — a key sign of market tightness — while swaps tied to the physical North Sea market have also increased amid frenzied trading of derivatives late Tuesday. Crude’s rise on Wednesday was supported by the American Petroleum Institute reporting inventories fell by 3.5 million barrels last week, according to people familiar with the numbers. If confirmed by official data, it would be an eighth decline in nine weeks. The oil price curve is offering the biggest yield in about a year, and investors are piling in. Supply cuts by Saudi Arabia are draining stockpiles in regions including China and helping boost confidence that the market has shaken off the worst effects of the coronavirus pandemic. While there are still concerns about near-term demand with many countries still in lockdown, vaccines have helped improve the outlook.

“Oil prices continue to grind higher on the combination of tight supply, a weak dollar and overall positive risk sentiment,” said Jens Pedersen, a senior analyst at Danske Bank.

Still, some like Vitol SA’s Asia head Mike Muller think the rally may have gone too far. A technical indicator is signaling oil is overbought and due for a correction. There are also concerns that elevated prices will prompt producers to pump more crude.

U.S. explorers are set to boost drilling and production from the second half of this year, with crude prices likely staying above $50 a barrel, the Energy Information Administration said in its Short-Term Energy Outlook on Tuesday. The agency also said the country’s petroleum consumption is unlikely to reach pre-pandemic levels until 2023.

Prices

Other oil-market news

Share This:

Oil Extends Longest Rising Streak in Two Years as Stocks Drain

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire