The recent rally is being backed by a surge of interest in commodities. The Organization of Petroleum Exporting Countries and its allies have pledged to keep draining a virus-driven surplus and there are expectations the global economy will recover this year, raising forecasts for stronger oil demand. Investor holdings of West Texas Intermediate futures have soared to the highest since 2018.

“Besides soft factors such as increased demand from investors in view of the pronounced price buoyancy, rising stock markets and economic optimism, the physical market is also looking increasingly tight,” said Eugen Weinberg, head of commodities research at Commerzbank AG.

| Prices |

|---|

|

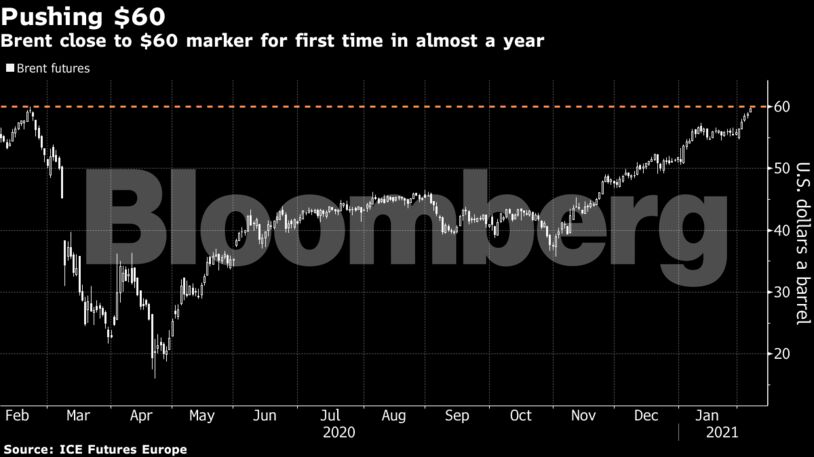

However, there are also reasons to be cautious. Oil at $60 a barrel will bring back more supply and keep any further gains in check, according to top trading firm Gunvor Group Ltd. Average WTI prices for the rest of the year are around $55 a barrel, while for next year they’re above $50, levels that could spur producers to pump more.

For now though, there are signs of ongoing strength as Saudi Aramco left its oil prices unchanged for Asia in March, defying expectations of a cut. It also hiked pricing to Europe and the U.S.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS