Big Oil’s performance is still “reflecting the worst of Covid-19,” said JPMorgan Chase & Co. analyst Christyan Malek. “Cash flows generated in the fourth quarter are a low point,” but should improve this year, he said.

The supermajors were forced to take on large amounts of debt to survive last year’s unprecedented slump in oil demand, and now the bill is coming due. They’re relying on assets sales and cuts to jobs and investment to repay borrowings and keep up with dividends, the cornerstone of their investment case.

The consequence is likely to be lower oil and natural gas production in coming years.

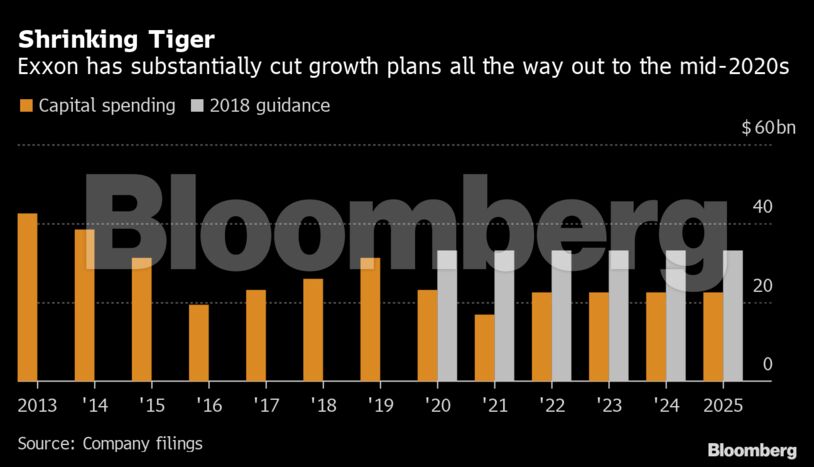

Exxon has all but abandoned its counter-cyclical growth strategy. It’s reduced capital expenditure to a record low this year, and plans to cut some $50 billion from its planned spending over the next five years. Sounding chastened, Exxon Chief Executive Officer Darren Woods said he will “make adjustments to our capital program depending on market conditions” and prioritize debt repayment.

Chevron Corp.’s capital spending is at the lowest in at least a decade and less than half 2014 levels. The California-based company is unwilling to resume its previous spending plans in the Permian shale basin, its key growth asset, until the effects of the pandemic are behind it. BP Plc’s planned $13 billion capital expenditure for 2021 is already at the lowest end of its budgeted range.

Still, investors got some good news. Shell reiterated its commitment to grow its dividend, with a 4% hike promised for the first quarter. Exxon pledged to maintain the S&P 500 Index’s third-largest payout payout even after making its first annual loss in four decades.

But still the pair bled cash. Neither company generated enough cash from operations to cover capital expenditures and payments to shareholders in the fourth quarter.

Earnings season isn’t over. France’s Total SE and Italy’s Eni SpA will publish results in the coming two weeks.

The French energy giant in particular has so far weathered the crisis so far better than its peers, having managed to preserve its dividend, expand oil and gas output and make the greatest inroads into clean energy, an area all the European majors have committed to growing.

And with crude prices rising the outlook is more positive.

“The only thing in their favor this quarter are oil and gas prices,” said JPMorgan’s Malek. The industry still has problems to overcome in refining and fuel marketing, but the “positive tailwinds” from prices should help improve cash flow.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS