SunShot’s targets were clearly delineated: achieve a specific cost per Watt for photovoltaic energy and concentrate various types of solar thermal power systems. By 2020, U.S. solar should have installed prices of $1 per Watt for utility-scale PV systems, $1.25/W for commercial rooftop PV, and $1.50/W for residential rooftop PV. (I won’t delve into SunShot’s concentrating solar power targets here, as that industry has failed to achieve meaningful scale.)

The U.S. solar industry crushed its utility-scale PV target in 2017, but it’s still a long way off from its commercial target, and prices are still a full 100% above its residential target. My solar analyst colleague Tara Narayanan described the latter, in particular, as “a very poor show” even though prices have already fallen by more than 60% in the decade.

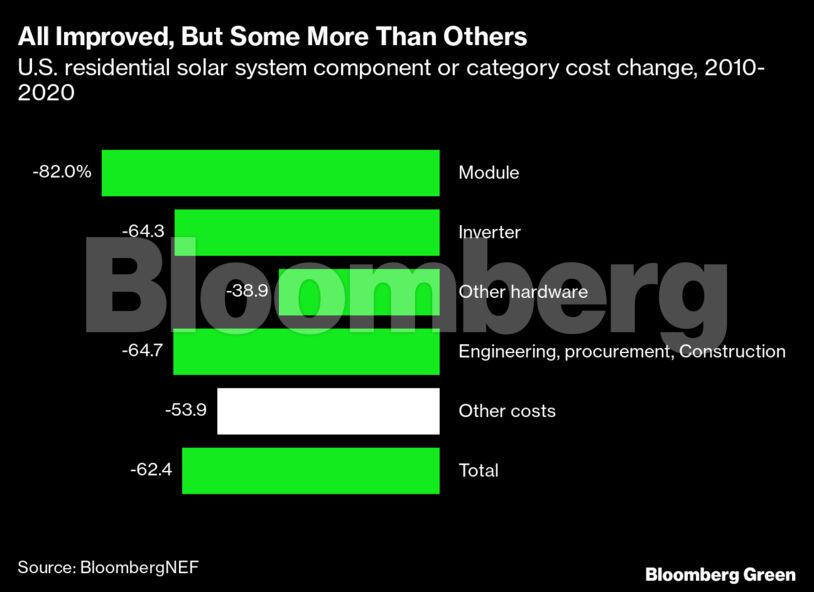

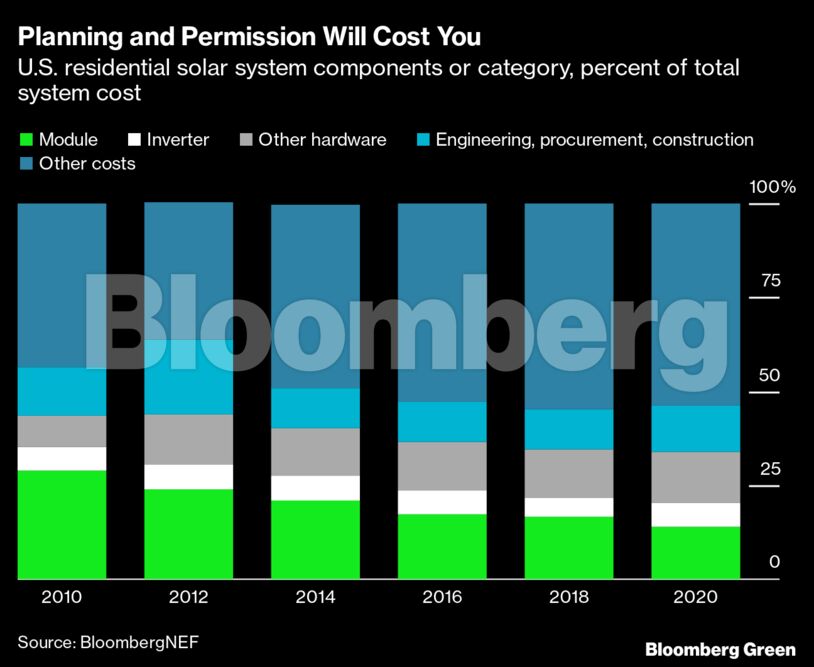

That poor show, however, is quite specific to one part of residential solar. It’s not a matter of major hardware costs like modules or inverters, or the cost of construction. The issue is with other costs, in particular planning and permission – things like the documents required to receive local approval for construction. To be fair, those costs have dropped by more than half. But with every other significant category declining more, planning and permission now account for more than half the total cost of a system.

The industry often refers to planning and permission as “soft costs,” because they reflect the price of services rather than materials. A better way to describe them, in the case of residential solar, is as “sticky” costs – those that don’t seem to respond to the same economies of scale that have caused the price of modules and inverters to plunge.

And they’re sticky in so many ways, too. My colleagues’ research finds that it can take more than two weeks to submit a permit for a residential solar project after a sale is closed. It takes the average building department a month to review and approve a proposal. In total, it can take up to 120 days from the time a contract is signed until a system is operational. Academic research finds that while some projects can move faster – in less than a month – they can also take up to 100 days to complete.

A few thoughts on where U.S. solar needs to go to belatedly hit the SunShot residential solar targets, and how we should look to the next round of innovations:

First, we should applaud the technological successes in reducing the cost of PV modules by 80%, and the technical success in cutting the cost of engineering, procurement, and construction by more than 60%. At the same time that costs have come down, quality, efficiency, output, and performance have all improved. Manufacturing at scale and building inexpensively with equally high quality are no longer major challenges.

Second, Covid-19 has forced many installers to use digital sales channels, and many building departments have had to accept permit applications electronically. It’s hard to imagine this digitalization of major processes reverting once the virus recedes. This will make it easier for buyers to compare prices, boosting competition and putting more downward pressure on costs.

Finally, I hope that the U.S. industry, policymakers and regulators will take SunShot’s 2010s ambition into the 2020s. They will have an exceptional set of tailwinds behind them: inexpensive, efficient technology that is cost-competitive and widely available; ample capital supply; growing demand. The next SunShot can be simpler, in a good way. It need not run through the laboratory, or the fabrication facility. It will need to go through sales, marketing, and the city buildings department.

Nathaniel Bullard is a BloombergNEF analyst who writes the Sparklines newsletter about the global transition to renewable energy. He was a contributor to the SunShot Initiative’s SunShot Vision Study.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire