The Houston contracts reflect a shift in the oil industry’s focus from the storage hub in Cushing, Oklahoma, the delivery point for New York-traded futures, to the Gulf Coast. A global appetite for U.S. crudes resulted in a new web of pipelines and terminals to connect the Permian Basin of West Texas and New Mexico to the world.

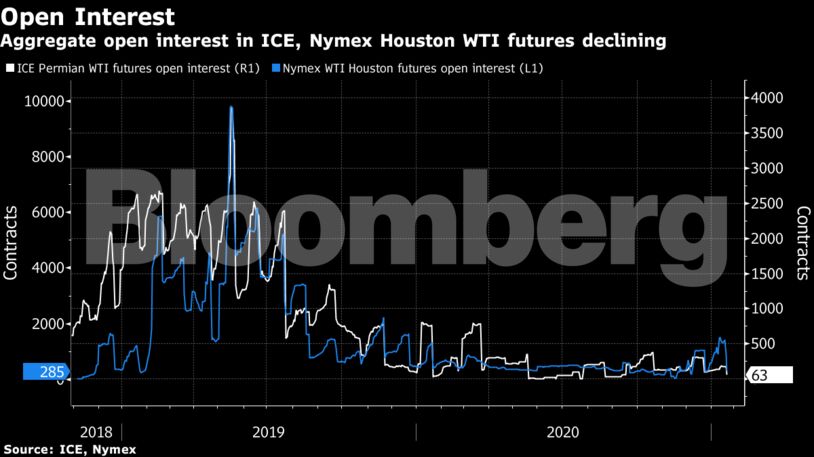

But liquidity is still thin for the existing instruments that began trading about two years ago.

“Having two competing oil futures contracts in a non-traditional area like the Gulf Coast may be cannibalizing each other, effectively hurting both contracts,” said Vikas Dwivedi, a global energy strategist for Macquarie Group in Houston.

The delivery points will be either Magellan’s East Houston terminal or Enterprise’s ECHO site in Houston. Both facilities are already used for two separate Houston oil futures contracts, Intercontinental Exchange’s Permian WTI contract and CME Group’s WTI Houston crude futures.

It’s unclear which exchange would host the new contract, or if existing futures contracts would be merged.

Enterprise did not respond to an email seeking comment.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS