By Grant Smith and Sharon Cho

U.S industry data pointed to a sharp drop in the nation’s crude stockpiles last week. If confirmed by government figures due Wednesday it would a sixth draw in seven weeks, compounding signals of reduced supply from other regions.

Saudi Arabia and Iraq are throttling back supplies next month as the OPEC+ coalition seeks to shore up prices against resurgent virus infections and new lockdowns. Russia is reducing seaborne exports and Libya has seen shipments interrupted by internal turmoil.

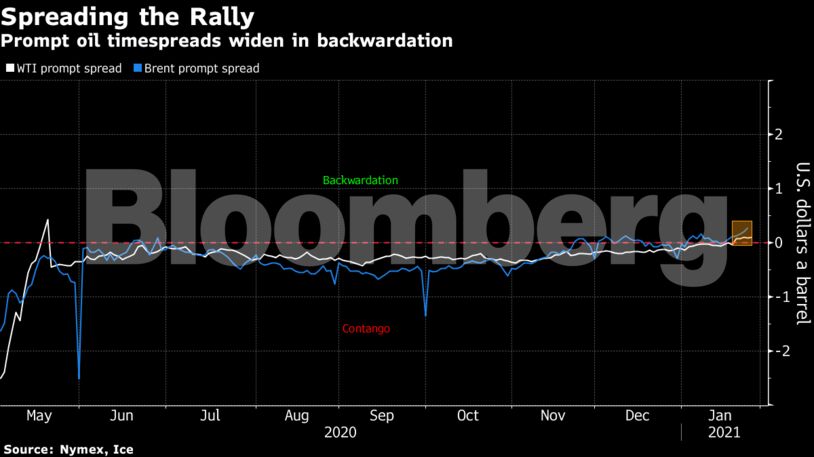

As a result, the overall market structure is reflecting a much stronger picture. The premium of Brent and West Texas Intermediate crude’s nearest contract is widening over the next one in a bullish formation known as backwardation.

“The front of the curve is surprisingly strong,” said Helge Andre Martinsen, senior oil market analyst at DNB Bank ASA. “With the Saudi cut from the start of February, the market balance flips to undersupply despite some demand softness. We have also witnessed some export hiccups in Libya, and increased cut compliance from Iraq.”

The oil market’s switch to backwardation means “we are hopeful that 2021 will be a good year,” the Organization of Petroleum Exporting Countries Secretary-General Mohammad Barkindo said Tuesday. Lingering near-term concerns about the demand impact of Covid-19 have been superseded, for now, by the Saudi cut.

The kingdom’s additional curbs won’t continue beyond March, but the roll-out of vaccines is spurring hope that the tide will then be turning. Global economic growth is forecast to pick up later this year. Broader financial markets are also awaiting the Federal Reserve monetary policy decision after its first meeting this year.

| Prices |

|---|

|

The American Petroleum Institute reported crude inventories fell by 5.27 million barrels last week, according to people familiar with the data. Stockpiles at the hub of Cushing declined 3.48 million barrels, while gasoline and distillates rose, according to the data.

“With U.S. supplies shrinking and OPEC+ still keeping a tight rein on the other part of the supply equation, the market is expected to be in a deficit despite the reduced demand from the resurgent virus,” said Howie Lee, an economist at Oversea-Chinese Banking Corp. in Singapore.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire