By Sharon Cho and Alex Longley

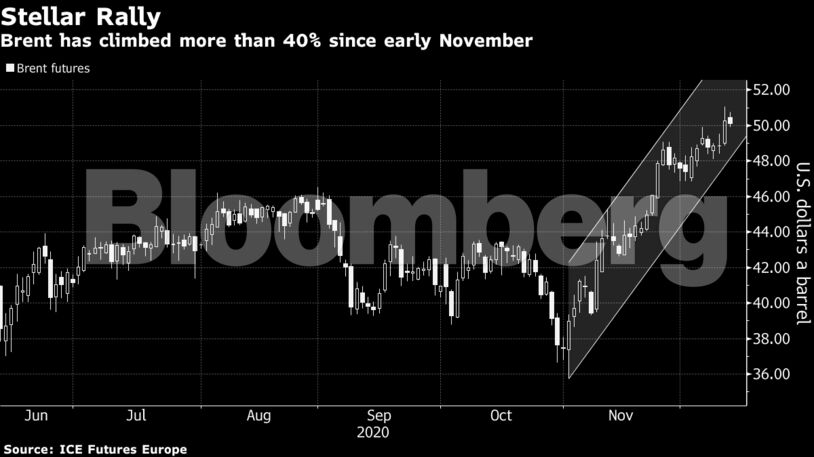

Prices erased earlier gains on Friday as the dollar climbed and equities fell. Brent crude had topped $50 on Thursday, though it settled technically overbought, suggesting a pullback may be on the horizon.

In the near-term, the market’s outlook is improving. Global demand for gasoline and diesel rose to a two-month high last week, according to an index compiled by Bloomberg, suggesting the impact of the most recent wave of coronavirus lockdowns is waning. Recent buying by Chinese and Indian refiners indicates Asian physical demand will likely remain supported for another month.

The first Covid-19 vaccine expected to be deployed in the U.S. won the backing of a panel of government advisers, helping clear the way for emergency authorization by the Food and Drug Administration. The market took OPEC+’s decision to restore a small amount of output in January in its stride and the oil futures curve is signaling investors are comfortable with the supply-demand balance and expect a recovery in consumption next year.

“The very fact that prices broke the $50 ceiling this week is positive for the market,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy. “A correction could be across the corner once the consequences of winter’s lockdown are more evident.”

| Prices |

|---|

|

Elsewhere, a key European oil pipeline resumed operations on Friday, after being halted for much of the week, according to OMV AG. The Transalpine Pipeline, which supplies Germany with oil, had been disrupted as a result of heavy snow.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS