A suggestion by President Donald Trump that he might not sign a stimulus bill into law also weighed on financial markets.

The new Covid-19 strain — which is possibly already in the U.S., Germany, France and Switzerland — is raising the risk of more stay-at-home measures that would sap energy demand. The U.K. is considering putting more people under a severe lockdown to halt its spread.

“Jitters surrounding the new strain of the virus remain front and center,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. “The specter of fresh restrictions now hangs over Europe together with the prospect of a drawn-out recovery.”

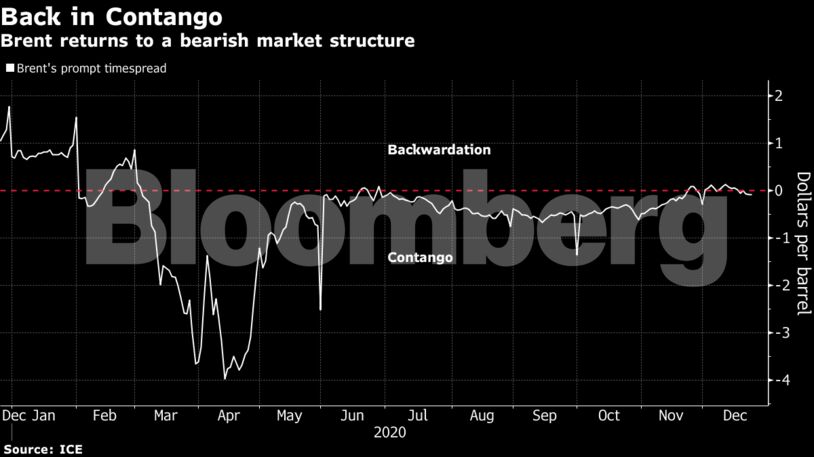

The threat to near-term demand from the virus mutation has rippled across crude markets.

Brent’s prompt time-spread has moved back into contango, a bearish market structure where near-dated prices are cheaper than later-dated ones. Global demand for oil liquids won’t return to pre-virus levels until early or mid-2022, according to Gazprom Neft PJSC Chief Executive Officer Alexander Dyukov.

| Prices |

|---|

|

The passage of the second-biggest economic rescue package in U.S. history through both chambers failed to revive oil prices earlier in the week. President Trump said he might not sign the $900 billion plan unless stimulus checks are increased.

U.S. distillate stockpiles increased by 1.03 million barrels last week, while there was a small decline in gasoline inventories, according to the API. Analysts surveyed by Bloomberg are forecasting a 3 million-barrel drop in crude stockpiles ahead of the Energy Information Administration data.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire