By Elizabeth Low

Futures dropped toward $47 a barrel in New York after the American Petroleum Institute reported crude inventories climbed by 1.97 million barrels last week, according to people familiar with the data. That would be a second weekly gain if confirmed by official government figures on Wednesday.

In Asia, meanwhile, a rally in the physical market is gathering pace as buyers snap up barrels at higher prices. However, the demand recovery is looking uneven with China’s daily oil refining rising to a record last month, but South Korea’s crude imports falling to a 10-year low and predicted to drop further. Indian diesel sales also slid in the first half of December from a month earlier.

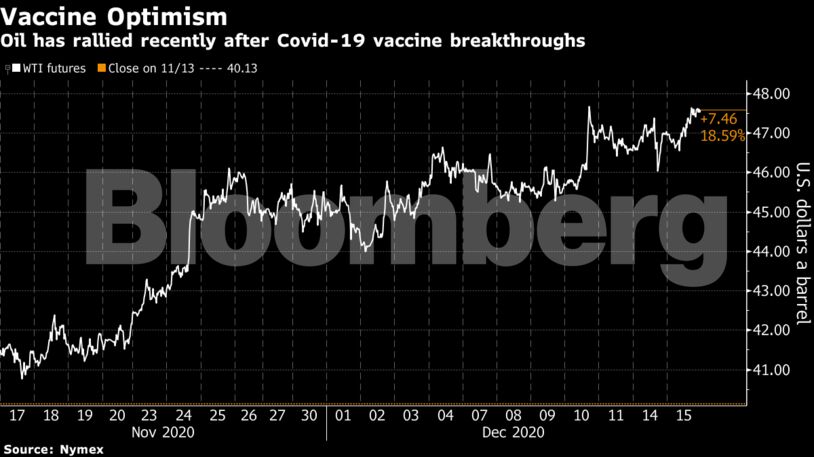

Optimism about a swift demand recovery with the rollout of Covid-19 vaccines has oil trading at levels last seen before the outbreak sparked lockdowns across the world, although the market is still facing a number of near-term hurdles. A resurgence of the virus is crimping fuel consumption in some regions and OPEC+ is set to unleash more supply next month after the group agreed to gradually ease its crude production cuts.

“There’s a huge risk to the vaccine rally, we are at peak vaccine optimism,” said Michael McCarthy, chief market strategist at CMC Markets Asia Pacific in Sydney. Oil may face further headwinds from a stronger U.S. dollar or a breakdown in the OPEC+ output agreement, he said.

Crude has climbed 2.3% over the past two sessions to the highest level since February as the U.S. Congress moved toward a stimulus package and as the nation started delivering the first doses of a coronavirus vaccine.

| Prices |

|---|

|

It’s still going to take some time to work through the crude glut left behind by the pandemic, with the International Energy Agency warning the surplus will clear by the end of next year. The market is facing a gradual recovery marked by renewed strains on demand, the agency said in a report on Tuesday.

U.S. gasoline stockpiles, meanwhile, expanded by 828,000 barrels last week, the API reported. Inventories of distillates, a category that includes diesel, increased by 4.76 million barrels.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran