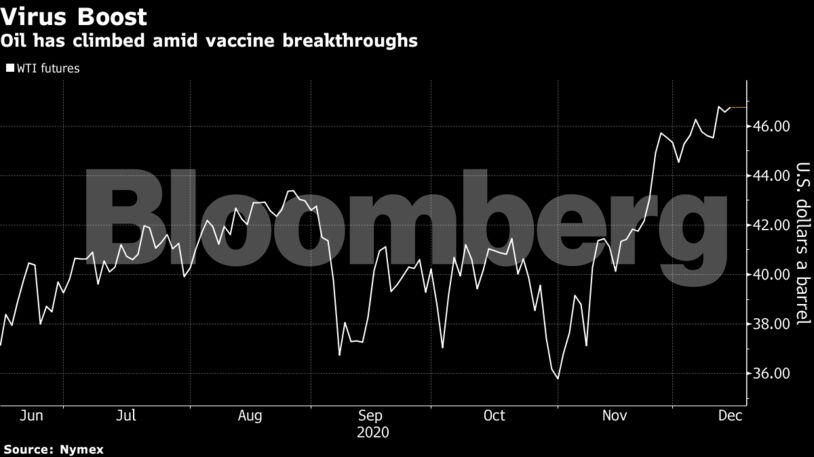

Oil in New York has advanced about 30% since the end of October amid vaccine breakthroughs and an OPEC+ compromise deal on output, with global benchmark Brent topping $50 a barrel for the first time in nine months last week. Iran, meanwhile, plans to almost double production in the next year in anticipation of a loosening of sanctions after Joe Biden becomes president.

“The rollout of the vaccine is going to have a positive effect on road fuel and eventually jet fuel demand,” said Stephen Innes, chief global strategist at Axi. “So much of the optimism in the price right now, I think, is warranted.”

Asian stocks rose and the dollar weakened, with the market also looking for progress on new stimulus in the U.S. A bipartisan group of lawmakers are set to unveil a $908 billion pandemic relief bill, although there’s no guarantee it will pass. Brexit talks were extended, meanwhile, raising hopes of a deal.

| Prices |

|---|

|

Brent’s prompt timespread was 7 cents a barrel in backwardation, a bullish market structure where near-dated contracts are more expensive than later dated ones. That compares with a 1 cent contango a week earlier.

All 50 U.S. states are expected to have the vaccine by Wednesday, with 2.9 million doses delivered in the first shipment. In general, the people to get the shot first will be health-care workers and vulnerable residents of care homes.

While parts of Asia have rebounded strongly from the virus-led crash and there are signs global demand is picking up after a November trough, the outbreak is continuing to dent consumption in some nations. South Korea is considering stricter social-distancing measures and Germany will enter a hard lockdown from Wednesday, which will last until at least Jan. 10.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS