By Natasha Doff and Áine Quinn

Her dilemma is one felt by investors everywhere with pressure mounting to keep pension and insurance money out of companies, and countries, that contribute to global warming. But what do you do if the fund you manage can only invest in a country like Russia, where many listed companies are in the business of digging up and selling fossil fuels?

“The weighting of oil, gas and metals companies in the market is so big in Russia that you can’t avoid those stocks,” Loven, who manages $1.1 billion in Russia and Eastern Europe stock funds at Swedbank Robur, told Putin at an online investment forum. “I want to know how much big companies will contribute to complying with the Paris Agreement and global targets for carbon neutrality.”

Her direct approach came at the end of a 2 1/2 hour Q&A session on Oct. 29 and wasn’t the first question on the climate policies of the world’s fourth-biggest carbon emitter. The issue is “very important,” Putin said, adding that Russia’s biggest companies will play a part in helping the nation achieve its climate goals.

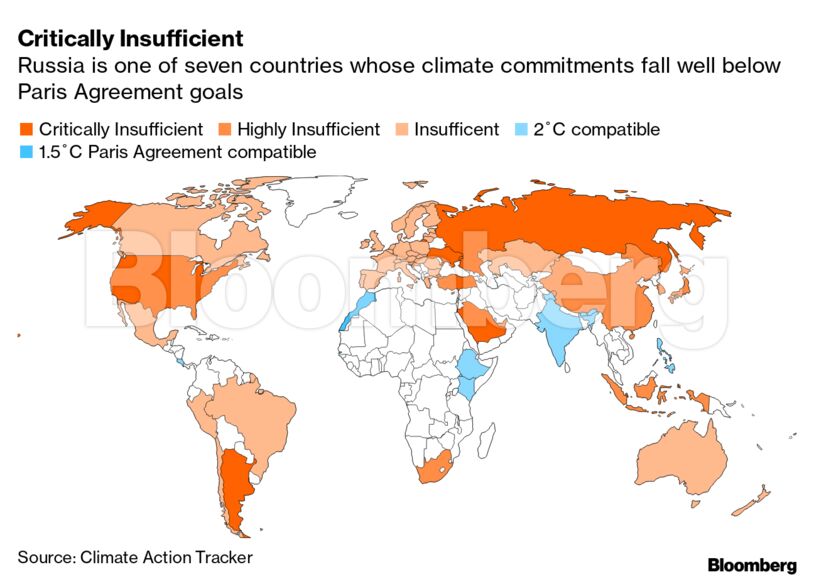

That may not come as a great reassurance. The Kremlin bases its commitments under the Paris Agreement on a year when Russia was a part of the Soviet Union and produced far more pollution than it does today, effectively allowing it to increase carbon emissions by 2030. Research group Climate Action Tracker ranks Russia’s preparedness to meet the Paris objectives “critically insufficient.”

Swedbank Robur is aiming for its entire managed portfolio to be in line with the Paris Agreement’s target of limiting global warming to 1.5 degrees Celsius in 2025, and with zero emissions for the entire portfolio by 2040.

Energy and materials companies make up nearly 60% of the Moex Russia Index, compared to just under 12% of the benchmark MSCI emerging-markets index. Russia’s biggest energy firms plan to expand production in the coming decades and, unlike their peers in Europe, haven’t pledged to transition to renewables.

The Swedbank Robur Rysslandsfonden fund that Loven manages has 25% of holdings in oil and gas companies, with banking stocks making up the second-biggest share. The fund has returned 8.2% in the past three years. beating 84% of peers, according to data compiled by Bloomberg.

Seven days after his comments at the conference, Putin signed a decree ordering the government to work toward meeting the Paris Agreement, but not changing Russia’s unambitious target.

Loven, who grew up in Moscow and has managed Russia and Eastern-Europe funds in Sweden for most of the past 15 years, said in a phone interview last week that Putin’s response to her question shows the government is making “sincere attempts” to improve. But she added that Russia is still far from adhering to the Paris Agreement, which calls for companies to transition away from fossil fuels.

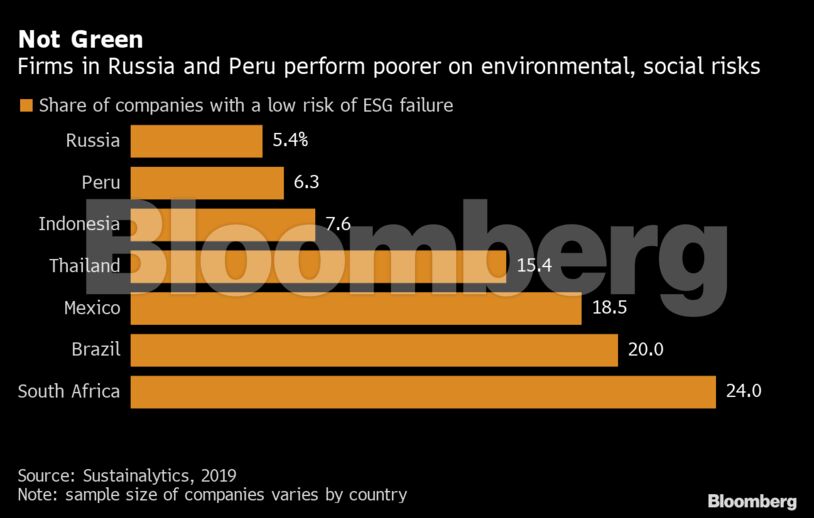

“In Europe it is quite straightforward: you can’t invest in a fossil fuel company unless it has promised and has a clear agenda to transform into something more sustainable,” she said. “For an investor with a focus on environmental, social and governance factors, Russia is becoming less and less attractive.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS