By Andres Guerra Luz

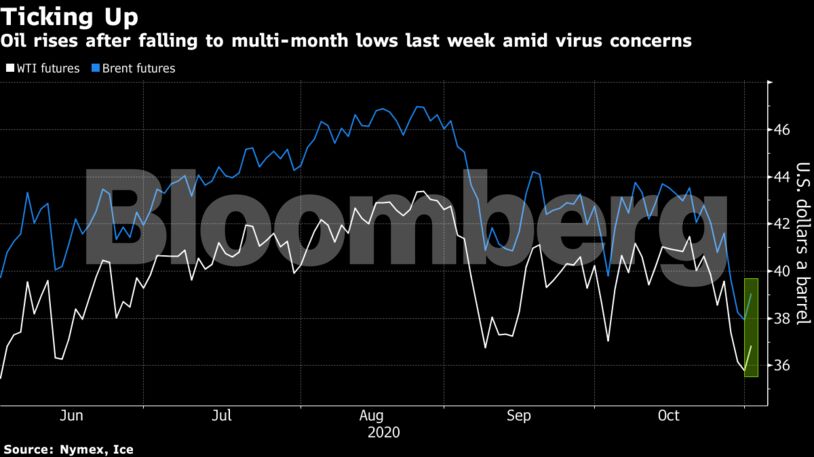

Futures had earlier sold off amid the double whammy of rising Libyan supply and a dwindling demand outlook as England joined the string of European countries to renew lockdowns. That could be just the curtain-raiser for a turbulent week of trading as Americans head to the polls Tuesday in an election that could reshape U.S. policy on everything from fiscal stimulus to Iran and fracking.

Expectations that OPEC+ will postpone its planned easing of output cuts in January have increased recently as new threats to the fragile demand recovery are compounded by the group’s own rising production. The second wave of the virus around the world could push global oil demand to as low 88 to 89 million barrels a day, down 11% or 12% from last year, Trafigura Group boss Jeremy Weir said at a conference.

“There’s not a whole lot that goes right for oil from here,” said Peter McNally, global head for industrials, materials and energy at Third Bridge. “Demand is unlikely to surprise to the upside, with lockdowns being reimposed.”

| Prices |

|---|

|

Despite the recent price weakness, Vitol Group, the world’s biggest independent oil trader, characterized the latest lockdown measures as just a “speed bump,” with tightening global inventories likely to cushion the downside. The bigger picture is still a world in “stock-drawing mode,” Mike Muller, Vitol’s head of Asia, said in an interview Sunday with Dubai-based consultants Gulf Intelligence.

At the same time, China raised the quota for use of overseas oil by non-state entities next year by more than 20%, presenting a bright spot for an otherwise precarious demand picture.

Still, the futures curve signals further weakness, with the spread between WTI’s nearest contracts deepening into its widest contango since early September. Brent’s prompt spread also weakened on Monday.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein