By Grant Smith and Julian Lee

The Gulf sheikhdom drew a rare public rebuke from OPEC’s de facto leader, Saudi Arabia, last month for a production surge over the summer that violated its agreed quota. It’s now moved closer to that limit again, with tanker-tracking data showing exports at their lowest in 23 months.

The Organization of Petroleum Exporting Countries and its partners — which include exporters such as Russia and Kazakhstan — are keeping supplies near the lowest level in decades to offset an unprecedented plunge in fuel demand. Their efforts are showing mixed success, with signs of inventories piling up again and oil prices stuck around $40 a barrel.

The UAE’s supply reversal underscores the urgency of the situation at the cartel’s highest levels. Tanker-tracking data show it throttled shipments back in late September, shortly after the censure from Riyadh. With the reduction, the UAE is now pumping 2.68 million barrels a day, about 90,000 above its mandated ceiling.

OPEC’s total output rose by 40,000 barrels a day to average 24.43 million, according to the survey.

The poll is based on ship-tracking data, information from officials, and estimates from consultants including Rystad Energy AS, Petro-Logistics SA, Kayrros SAS, Rapidan Energy Group and JBC Energy GmbH.

Increase Elsewhere

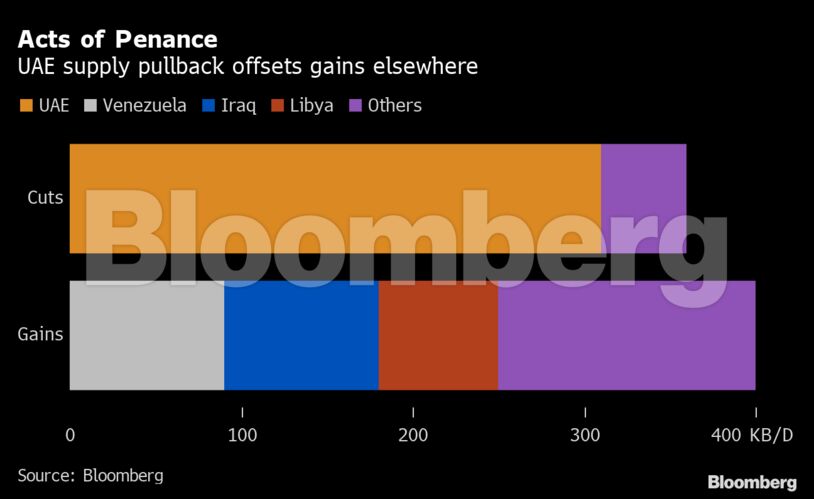

The UAE’s curbs effectively offset increases seen last month in several of OPEC’s most troubled members.

Venezuela, Libya and Iran — which are all exempt from the group’s agreement to restrain output because of internal crises — collectively added 190,000 barrels a day.

Caracas delivered the biggest increase of the three, with an unusual output boost of 90,000 barrels a day. Yet with production of just 400,000 barrels a day as an ongoing economic meltdown continues to take its toll, the once-formidable producer is barely pumping half of what it was a year ago. September’s revival may easily dissipate as tighter U.S. sanctions take effect in coming months, according to Rapidan.

Libya achieved its first significant production increase in more than a year after the military commander controlling the conflict-torn nation’s oil ports allowed shipments to resume. It boosted output by 70,000 barrels a day to 150,000 a day on average last month. Production reached about 300,000 barrels a day at the end of September, according to separate Bloomberg estimates.

However, recent history in the country, fought over by competing armed factions, has shown that its gains may prove fragile.

Less Obedient

While the UAE demonstrated readiness to mend its ways, other members were less obedient.

Iraq is among the OPEC nations assigned extra compensatory cuts in recent months to make up for excessive production at the start of the agreement. After making a modest start on these in August, the country relapsed last month, raising production by 90,000 barrels a day to 3.78 million.

READ: Iraq, Fretting Over Oil Market, Reaffirms Vow to OPEC+ Cuts

What reprisals, if any, it may suffer from the OPEC+ leadership will become clearer later this month, when key nations convene for a regular monitoring meeting.

At that session, scheduled for Oct. 19, coalition leaders Saudi Arabia and Russia may also reflect on the next stage of their strategy. OPEC+ is currently due to restore more output at the start of next year in anticipation of a stronger global economy. But as the outlook darkens amid the resurgence of the pandemic, that policy may need to be reconsidered.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS