By Sharon Cho and Alex Longley

Crude futures gained 1.6% in New York. They earlier fell 1% as the International Energy Agency warned of a fragile market outlook and Russia indicated OPEC+ may stick with current plans to lift production starting January.

Along with a falling dollar, there were some bright spots in the demand picture. One Chinese mega-refiner is snapping up barrels of Middle Eastern crude to feed trial runs of its expanded plant. At the same time, India’s refiners have cranked up processing to meet higher consumption during a festive period.

Traders’ attention has turned to plans by OPEC+ to raise supply in 2021 in line with its agreement earlier this year. While some producers inside the group are said to have doubts, the United Arab Emirates and now Russia have said that, for the time being, the group intends to proceed as scheduled. Saudi Crown Prince Mohammed Bin Salman and Russian President Vladimir Putin on Tuesday urged the alliance to comply with agreed cuts as virus infections rise again.

“OPEC+ could provide a silver bullet by not tapering cuts at the start of next year as planned,” said PVM Oil Associates analyst Stephen Brennock. “But such a proposition will be hard to swallow by some of the group’s members.”

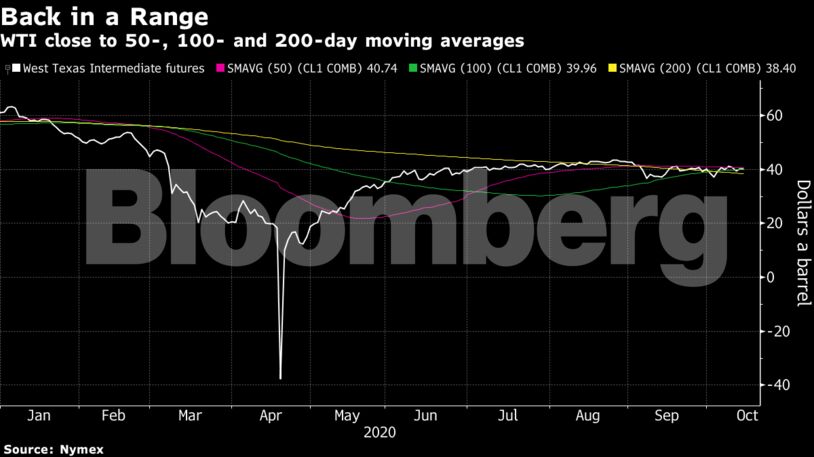

| Prices |

|---|

|

Despite its cautionary outlook, the IEA said that the oil market will see inventories fall by 4.1 million barrels a day in the fourth quarter. Demand is currently at about 94% of 2019 levels, it said, but this could be jeopardized by a surging pandemic.

Crude is being pulled out of storage tanks at the Saldanha Bay terminal in South Africa as OPEC+’s output curbs remain in place for now. A supertanker is taking a cargo of crude to India, while another smaller vessel is heading to France. Fuel stocks at Fujairah, a Middle Eastern hub, are also sliding.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire