By Alex Longley

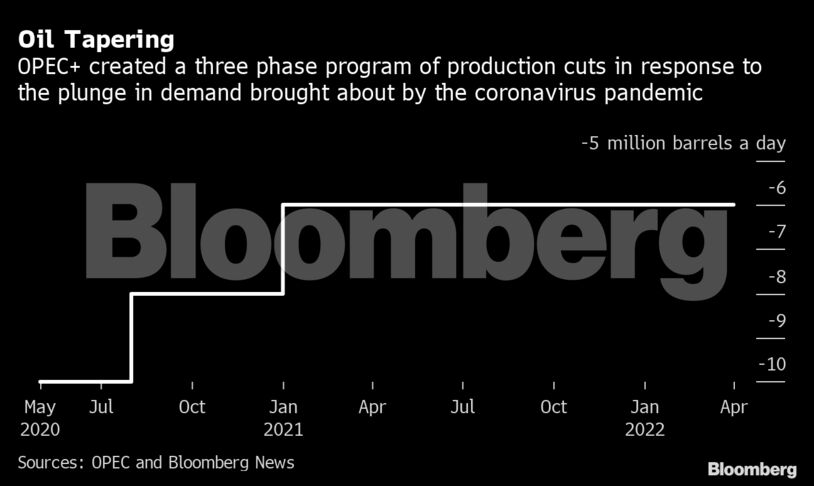

As well as the U.S. and Libya, a strike in Norway was canceled on Friday which added more bearish supply news. It all comes as the OPEC+ alliance considers whether to proceed with a plan to restore more output in January. With coronavirus cases accelerating in many countries, the group faces a tough decision at its next policy meeting on Nov. 30-Dec. 1.

“Potentially bullish supply-side developments subsided,” said Harry Tchilinguirian, an oil strategist at BNP Paribas SA. “Libya took a big step in restoring its oil production with the El Sharara field to resume output.”

| Prices |

|---|

|

In the latest sign of refiners struggling to cope with lower demand, Italy’s Saras SpA said it will furlough its entire workforce. The company said its Sardinia plant will effectively operate at the minimum required rate.

Iraq expects crude prices to remain at around $41 to $42 a barrel this year before rising to $45 in the first quarter of 2021, the state-run Al-Sabah newspaper reported, citing an interview with Oil Minister Ihsan Abdul Jabbar. The minister reiterated that Iraq, OPEC’s second-biggest oil producer, would continue to comply with the OPEC+ pact to curb output.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire