By Ann Koh and Alex Longley

Trump told his negotiators to stop talks with Democratic leaders just hours after Federal Reserve Chair Jerome Powell stepped up his call for more spending to avoid damaging the economic recovery. Crude futures in New York fell as much as 3.1% on Wednesday after two days of increases.

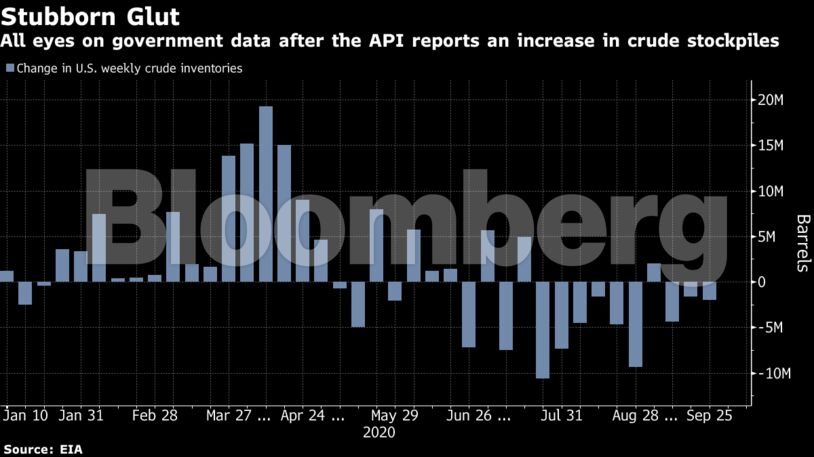

It was helped lower after the American Petroleum Institute reported U.S. crude inventories expanded by 951,000 barrels last week, according to people familiar with the figures. That would be the first gain in four weeks if confirmed by government data due later Wednesday.

Oil has whipsawed the past few days, driven by the prospects of financial stimulus and President Trump’s Covid-19 diagnosis. While rising OPEC+ supply and a resurgence in virus infections around the world are bearish, a workers’ strike that’s shutting down fields in Norway and a hurricane approaching the Gulf of Mexico are likely to provide some support.

See also: Oil’s Three-Speed Recovery Has Turned the Industry Upside Down

Trump’s intention “to postpone talks about economic aid until after the elections is weighing on prices today,” said Carsten Fritsch, analyst at Commerzbank AG.

| Prices |

|---|

|

In a sign of recovering strength in the physical market, Saudi Arabia slightly raised the price of its flagship Arab Light crude to Asia. The increase for November marks a change in course for the world’s biggest crude exporter after it pared rates in September and October as consumption stagnated.

Still, the Saudis face a conundrum in the coming months as the Organization of Petroleum Exporting Countries and its allies decide whether to bring back more supply in line with their agreement. Vitol Group, the world’s biggest independent oil trader, expects the group won’t relax production cuts in January because demand is recovering more slowly than forecast from the coronavirus crisis.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein