By Alex Longley

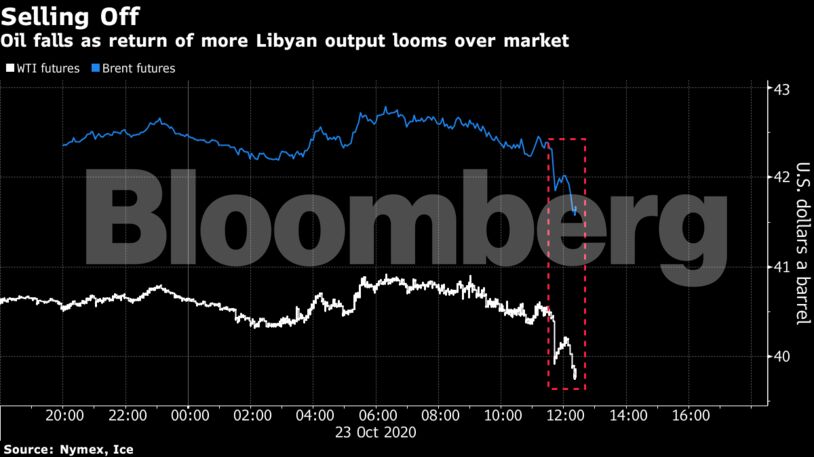

Prices were already edging lower after White House economic director Larry Kudlow said “the ball’s not moving much right now” on talks over another round of virus aid, though House Speaker Nancy Pelosi told MSNBC that a pre-election stimulus bill can still be passed if President Donald Trump cooperates. Meanwhile, the pandemic continues to worsen, with curfews widening in Europe amid fresh outbreaks and the U.S. case count topping 70,000 for the first time since late July.

“The apparent nationwide ceasefire in Libya is only going to encourage more production there and keep it steady, at least for a while,” said John Kilduff, a partner at Again Capital LLC. Meanwhile, “the Covid situation is not really improving, if not getting worse. So we’re continuing to deal with that as well.”

With futures stuck below $40 a barrel, attention is turning to the next major events on the horizon: the U.S. election and an OPEC+ meeting at the end of next month. On Thursday, Russia indicated for the first time that it’s open to delaying an oil-output hike planned for January. At the same time, the unexpected return of Libyan output adds another complicating factor for the group’s next move. Meanwhile, American presidential candidate Joe Biden said fossil fuels need phasing out over time, a comment seized on by Donald Trump as a threat to the industry.

“At the moment, there is little that seems to change this playing field for the oil market,” said Hans van Cleef, senior energy economist at ABN Amro. “However, two crucial events — namely the U.S. elections on Nov. 3 as well as the OPEC+ meeting at the end of November — may cause the oil market to move significantly in the coming weeks.”

| Prices |

|---|

|

The spread between Brent’s nearest contracts, which had firmed in recent sessions, deepened further into contango as the prompt price fell after the National Oil Corp.’s projected a boost in Libyan output.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein