By Nathaniel Bullard

There’s more to the story, though. To get the full picture, it helps to look at the full picture of sustainable debt.

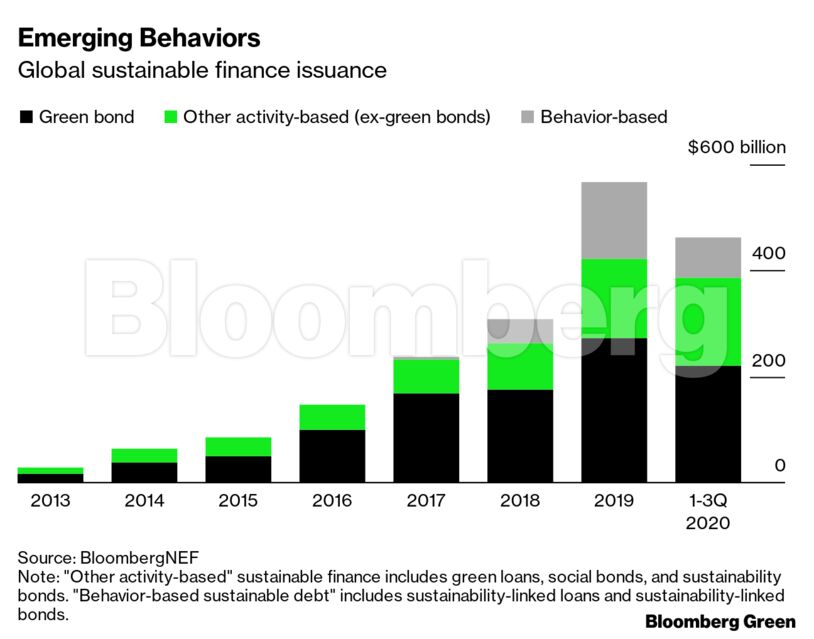

BloombergNEF sorts it into two buckets: “activity-based” and “behavior-based.” Activity-based sustainable debt issuers use the funds on sustainable projects such as a wind farm, an energy efficiency retrofit, or emissions reductions. This bucket includes green bonds as well as green loans, social bonds, and sustainability bonds. It’s traditionally the province of asset-heavy companies such as utilities and infrastructure developers, as well as governments and financial entities.

Behavior-based sustainable debt, on the other hand, is tied to issuers’ sustainability targets. That means a much broader range of companies can easily issue sustainable debt, even if they don’t have the appetite for or ability to invest in fixed assets like solar arrays and transmission towers. Performance targets for behavior-based debt could include goals such as reductions in emissions intensity, eliminating waste from operations, improving workforce diversity and labor safety, etc. Consumer packaged goods firms, fashion houses, and telecommunications providers have all recently raised behavior-based sustainable debt.

Today, only activity-based green bonds have made it to trillion-dollar scale—a noticeable, not negligible benchmark. But when you add activity-based and behavior-based bonds, we’ve already passed $2 trillion of sustainable debt.

Other activity-based sustainable debt is more than halfway to a trillion dollars, and behavior-based sustainable debt is more than a quarter of the way there. Growing them both to trillion-dollar scale will require more companies issuing sustainable debt, of course. It will also require greater scrutiny of issuers’ accounting of their activities and behaviors. And if it’s to avoid being seen as “nothing but a passing investment fad,” it will require hard work. But with all due respect to Drake and the late T. Boone Pickens, in debt, the first trillion is the hardest.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein