By Stephen Stapczynski and Javier Blas

With winter in the northern hemisphere fast approaching, the Covid-19 pandemic is prompting families to buy outdoor heaters. Restaurants and bars are also snapping them up to provide al fresco dining and drinking, while Google searches for “patio heating” have jumped to a record high. These heaters rely on electricity or liquefied petroleum gas, like propane.

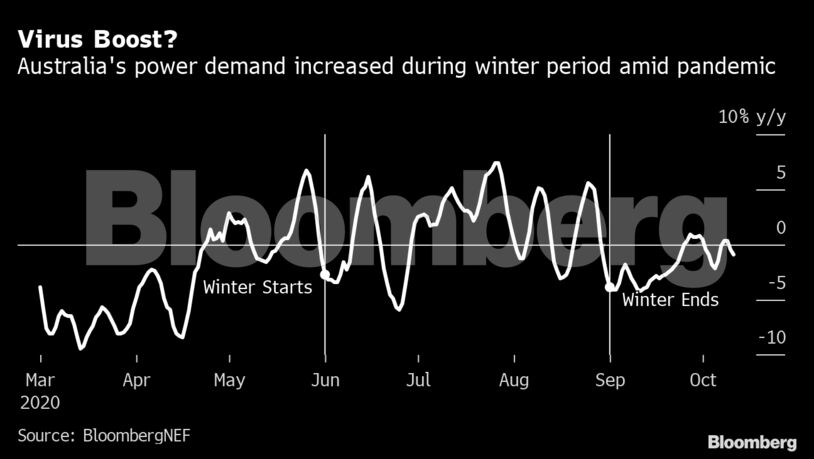

Residential energy demand is set to increase in the coming months as millions of people in Europe, Asia and North America spend more time at home — either working, studying or relaxing on their patios. With many offices still open, commercial use should remain steady, creating a so-called ‘double-heating effect’ that could lead to more use of everything from kerosene to natural gas.

Commodity traders are also beginning to bet on a colder-than-normal winter, due to the formation of a La Nina weather pattern in the Pacific Ocean. That — combined with the impact of the coronavirus — may mean that demand for some energy products could be surprisingly strong.

“Weather agencies are forecasting a cold start to the 2020–21 winter,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. in London. “Demand for LPG, kerosene, heating oil and low-sulfur fuel oil could all be boosted by varying degrees.”

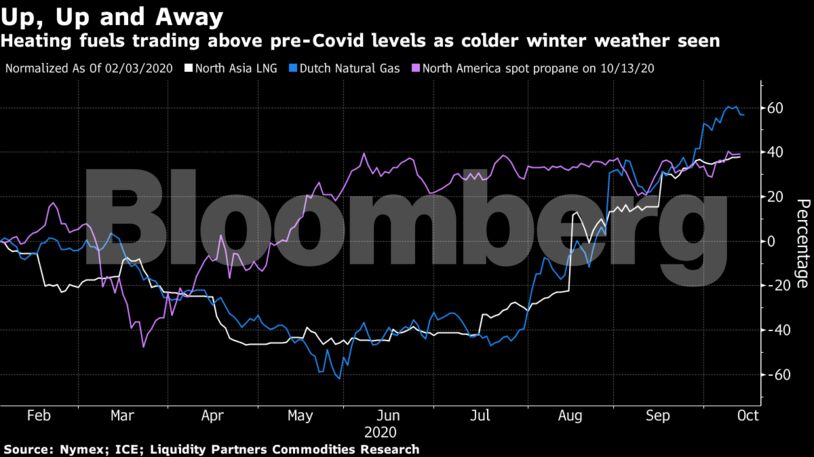

The likelihood of higher-than-usual demand has already started to filter through to the market:

- U.S. spot propane prices rose to the highest level this year last week

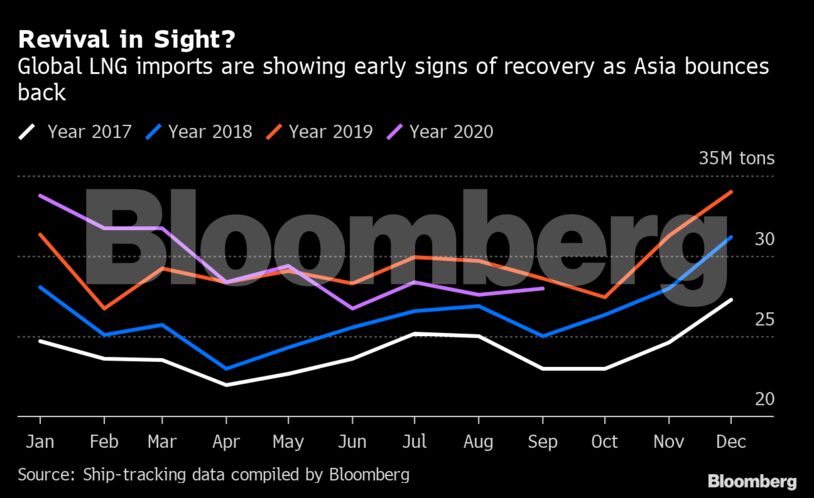

- The price of natural gas, used to heat homes or produce electricity, has jumped in Asia and Europe to the highest since before the virus

- Double heating could add 5% to gas demand for Europe, said James Huckstepp, manager for EMEA gas analytics at S&P Global Platts

- Meanwhile, the U.S. Henry Hub gas benchmark rallied to a 19-month high earlier this week amid optimism for colder temperatures

- Asian kerosene margins have recovered to $1 a barrel from as low as minus $2 in early September amid an uptick in demand from Japan, where the fuel is used for heating households

- The Organization of the Petroleum Exporting Countries said it expects an increase in U.S. heating oil consumption

The La Nina pattern is expected to bring below-average temperatures to North Asia, which is home to the biggest LNG importers, along with western Canada, parts of the northern U.S. and southern Europe, according to Todd Crawford, chief meteorologist at the Weather Company.

Total winter natural gas demand rose by a third from the previous year due to the last major La Nina in 2010-2011, Australia & New Zealand Banking Group Ltd. said in a note this month. A colder winter will also likely boost thermal coal consumption in China, while traders say that Japanese buyers have been stockpiling kerosene.

It still isn’t clear, however, whether double heating will be enough to overcome the virus-induced drop in demand from major industrial users, which are generally the biggest consumers of electricity, natural gas and some oil products. This has forced analysts to rethink how they forecast winter demand.

Some of the biggest buyers of liquefied natural gas — including Korea Gas Corp. and China National Offshore Oil Corp. — have scrapped their usual winter demand models, according to traders, and are rebuilding them from the ground up as they evaluate how the pandemic is upending energy consumption patterns. And while European and Asian natural gas prices have rallied they’re still at the lowest seasonal level in over a decade, indicating a degree of anxiety over how consumption will play out this winter.

“In the short term, estimates for winter demand will need to grapple with the depth and duration of lockdown measures, and figure out what impact this will have on both total demand and intraday profiles,” said James Whistler, the global head of energy derivatives at Simpson Spence Young, an international commodity and ship broker. “The risks of continued restrictions and second waves are high, and companies should expect demand to be volatile.”

The spread of the virus and the extent to which major economies are forced to impose more restrictions will be key. Europe is already struggling with a fresh wave of infections and there’s a risk the same phenomenon will happen in the U.S. The picture in North Asia looks better, although more people are working from home than usual.

Energy consumption will be highest where there’s an inconsistent and unpredictable division between working at home and the office, said Liam O’Brien, an associate professor at Carleton University’s Architectural Conservation and Sustainability Engineering program in Ottawa. A lot will depend on whether commercial buildings are operated based on occupancy and if the ventilation rate is increased to reduce Covid-19 transmission, he said.

High numbers of people working from home could intensify power demand when there are sudden cold blasts, but by how much is uncertain. The lack of clarity is spurring more swings in energy markets. Implied volatility in the Henry Hub gas benchmark in the U.S. is at the highest in at least a decade, suggesting the market expects more dramatic price moves.

Grid operators usually rely on large industrial facilities to anchor their demand forecasts and help with reactive power support, IHS Markit said in a note. But with some of these plants halted amid an uncertain economic outlook, operators are in uncharted territory.

“The double-heating effect will likely have a bigger impact on peak demand rather than overall energy demand,” said James Taverner, an IHS analyst in London. “This is something transmission system operators will be watching very closely.”

California’s grid operator was forced to implement rolling blackouts over the summer for the first time in nearly two decades due largely to its inability to forecast power demand during the pandemic. U.S. grid operators have had to repeatedly recalibrate their models as lockdowns disrupted economic activity and then partial re-openings shifted energy use again.

There’s also another unknown that will complicate forecasting as the mercury drops: what’s the temperature threshold at which house-bound workers and students will begin to warm their homes and which method will they use?

“You don’t know how efficient heating appliances are,” said Mark Byron Todoroff, head of business development at Tesla Asia Pacific, a power demand forecaster. “If a gas-dependent population suddenly uses a lot of electric space heaters during the day, and the heat is on at the office, we could be in for some surprises.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein