By Nathaniel Bullard

It’s always worth watching these announcements, even if their impact is unclear at first. We’ve had some other commitments recently, though, that are even more immediate, and to me more compelling. They’re quieter; they’re more technical; they start small. But they’re also forcing functions—they won’t just target change, they’ll make it happen.

The first is reinsurance giant Swiss Re AG’s decision to raise its internal carbon price, which companies use to estimate the costs of various business decisions, to $100 per metric ton next year, gradually increasing to $200 by 2030. The company claims it’s the first multinational to levy a triple-digit price on “both direct and indirect operational emissions.” Its current carbon price is a mere $8, making the new value a 1,150% jump.

A carbon price that high won’t allow a company to continue its business as usual. Case in point, Swiss Re also announced that it will cut emissions from air travel by 30% in 2021 relative to a 2018 benchmark, which means that “the currently suppressed business travel activity will not go back to the pre-COVID-19 levels,” the company said in a release. That price isn’t just hypothetical: Swiss Re will apply it as a tax across its internal operations, and the proceeds will pay for projects that actively remove carbon dioxide from the atmosphere.

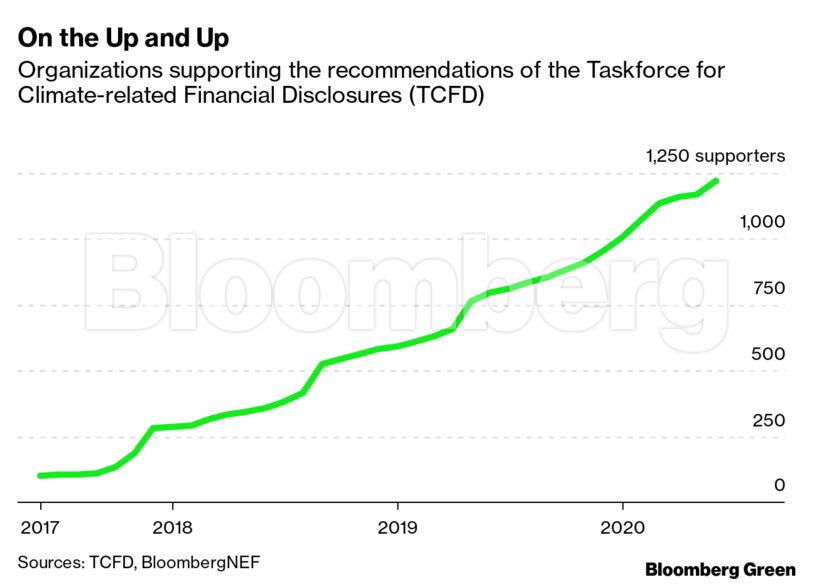

One more forcing function that we should watch closely is regulatory instead of financial. New Zealand will be the first country in the world to report on climate risks based on the Taskforce on Climate-related Financial Disclosures framework. About 200 organizations will now be required to disclose their exposure to phenomena such as extreme heat and rising heats by 2023, including NZ Super Fund, the country’s government savings institution. (Michael R. Bloomberg, founder and majority shareholder of Bloomberg News parents company Bloomberg LP, is the chair of TCFD.)

This new requirement is in a small market; the New Zealand stock exchange’s $743 billion market capitalization makes it about the same size as China’s Alibaba and just slightly bigger than Facebook. The TCFD’s standards are quite technical, though with the rapid growth in the number of organizations supporting its recommendations, there are more and more institutions acquainted with its standards.

New Zealand’s move is the first of its kind, but it’s unlikely to be the last, particularly as regulators, policymakers, and companies learn from New Zealand’s roll-out. What market might be next? I’d look to the other end of the earth: Canada, where the government tied Covid-19 support funds to TCFD reporting.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS