By Ann Koh and Alex Longley

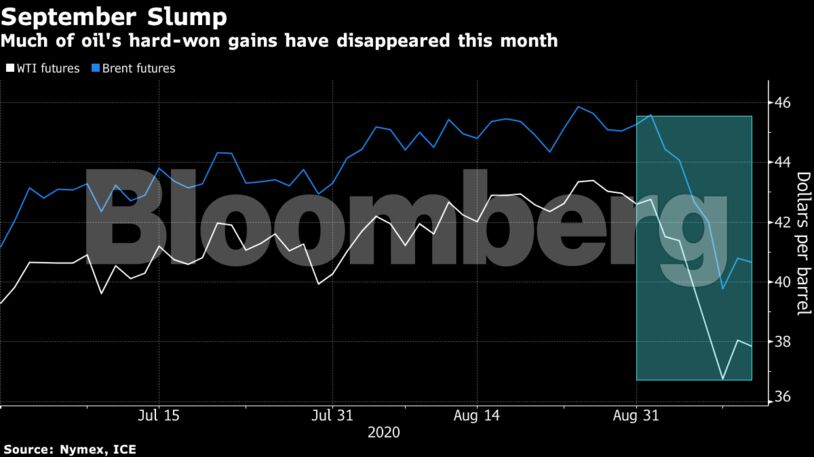

The American crude benchmark is down 12% this month amid signs it will take longer than initially anticipated to return to pre-coronavirus levels of energy demand. Since the start of the month, road traffic has grown in Europe and Asia, though the picture is uneven in the Americas, adding to oil’s mixed outlook. The onset of the refinery maintenance season is also clouding prospects for consumption already devastated by the pandemic.

“Uncertain oil-market fundamentals are holding prices back,” said Jens Pedersen, a senior analyst at Danske Bank. The “climb in U.S. crude stocks plays into the market worries over weak demand.”

| Prices |

|---|

|

The picture doesn’t look much better for refiners. Global refinery utilization may stay around 75% of capacity until early 2021, if processors have to clear the ongoing surplus in oil-product inventories, Citigroup Inc. said in a note.

Brent’s six-month timespread was $2.71 a barrel in contango — where prompt prices are cheaper than later-dated ones — compared with $1.97 at the end of August. The change in the market structure indicates growing concern about a glut and may also, together with falling tanker rates, incentivize floating storage.

–With assistance from James Thornhill.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein