By Saket Sundria and Alex Longley

The U.K. said it’s close to a “tipping point” with the public health crisis, while there were predictions of at least one more virus cycle in America. That helped drive down European equities by the most since July, while U.S. stock futures also dropped.

U.S. benchmark crude prices jumped 10% last week after a show of determination by Saudi Arabia, the most influential Organization of Petroleum Exporting Countries member, to defend the market. The Saudis hinted they’re prepared for new output cuts, and lambasted OPEC+ nations that have cheated on quotas. But demand and supply worries have returned for investors at the start of this week.

“Between tough talk from Saudi Arabia and the possible resumption of Libyan oil production, the oil market is facing a fork in the road this week,” said Harry Tchilinguirian, oil strategist at BNP Paribas SA. “Which option it chooses to travel will largely depend on how much real progress will come about in Libya.”

| Prices |

|---|

|

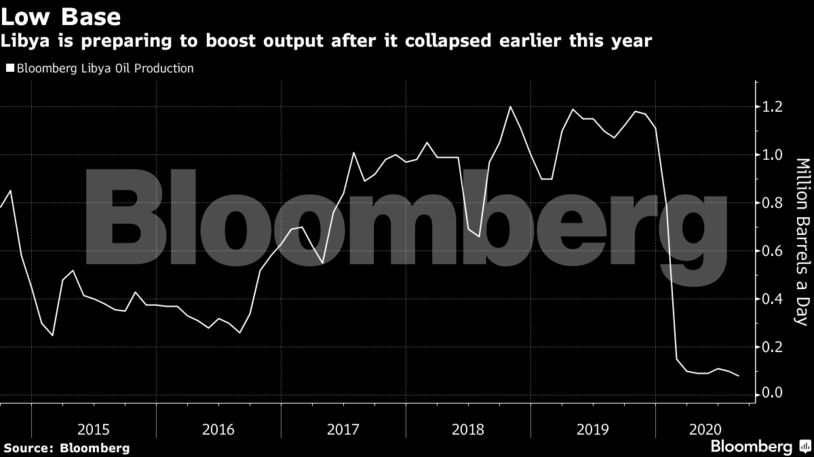

Libya’s National Oil Corp. is ending force majeure — a legal status protecting a party that can’t fulfill a contract for reasons beyond its control — at “secure” facilities in the conflict-ridden nation and has told companies to resume production. The country’s overall oil production is set to reach 310,000 barrels a day in a few days from the current 90,000 a day, according to a person with direct knowledge of the situation.

Output will probably increase to 550,000 barrels a day by the end of 2020 and to almost 1 million by the middle of next year, according to forecasts from Goldman Sachs Group Inc. Production, which was 1.1 million at the end of last year, slumped after Khalifa Haftar, a Russian-backed commander who controls eastern Libya, blockaded energy infrastructure.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire