By David Wethe

“Oil probably in the second quarter faced the biggest challenge it’s ever seen with the largest demand shock that oil has ever experienced,” James West, an analyst at Evercore ISI, said Wednesday in a phone interview. But “we’ve still got plenty of runway for fossil fuels and hydrocarbons. While there’s still a movement to bring in alternatives, they lack some critical mass, and we’re going to be using oil and gas, particularly natural gas, for the foreseeable future.”

U.S. shale drillers, many of which borrowed heavily to pay for drilling rights in prime areas and kept boosting output even as crude prices slumped from the highs reached in the last decade, were among the first to go bankrupt. High-profile victims so far this year included Whiting Petroleum Corp., once the largest oil producer in North Dakota’s Bakken shale region, and Chesapeake Energy Corp., the archetype for America’s extraordinary shale-gas fortunes. Though international oil majors like BP Plc and Chevron Corp. have stronger balance sheets, they’ve eliminated thousands of jobs.

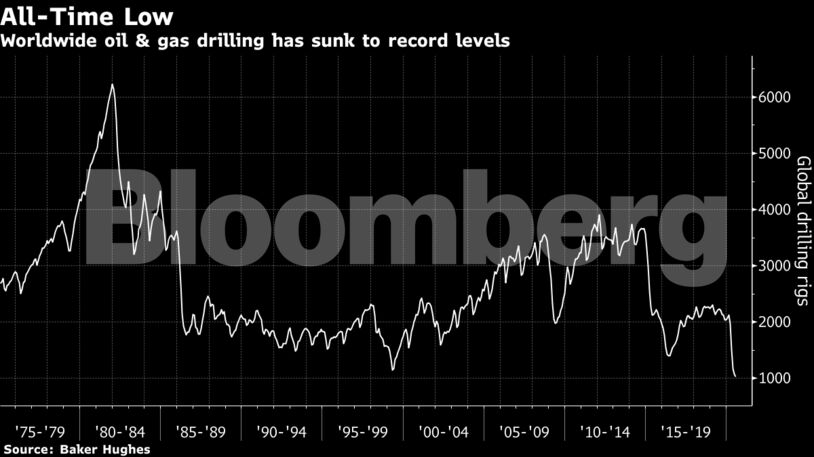

Oilfield servicers and offshore rig providers soon followed shale drillers into bankruptcy. Oil contractors at sea are going bust at the fastest pace in three years as explorers spurn high-cost drilling to deal with the worldwide slump in commodity prices. While newer deep-water projects are less expensive, they still take longer to develop than land-based shale wells and typically are more costly.

Valaris, which was created in 2019 out of the combination of Ensco Plc and Rowan Companies Plc., joins rivals Noble Corp. and Diamond Offshore Drilling Inc. in bankruptcy. Pacific Drilling SA earlier this month said it may return to bankruptcy court for the second time in less than three years, and Transocean Ltd., the world’s biggest owner of deep-water oil rigs, has said it’s exploring strategic alternatives.

“Offshore drilling is structurally damaged, and recovery is not imminent,” Bernstein analyst Nicholas Green wrote Wednesday in a note to investors. “New contract tenders are few, highly competitive and low priced; most players are badly over-levered and in desperate need of cash.”

Mixed Record

Valaris’s bankruptcy comes days after the Trump administration authorized a sweeping plan to sell drilling rights and spur oil development in Alaska’s rugged Arctic refuge. While Trump has touted U.S. energy dominance, his record in addressing oil-industry priorities has been mixed. Even as he personally intervened to help broker a global pact to cut oil output this spring, the president trumpeted low crude and gasoline prices as a “tax cut” for consumers.

Energy industry leaders have griped that despite his supportive rhetoric, Trump has routinely prioritized other segments of the U.S. economy, including coming to the defense of coal at the expense of natural gas and adopting steel tariffs that sparked concern about higher pipeline costs. They were also disappointed in his decision to forgo a chance expand offshore oil and gas leasing in the eastern Gulf of Mexico, amid concerns it would hurt his chances of re-election in Florida. Other moves to aid energy interests have been blocked in court.

Under Trump, the Interior Department has rebuffed offshore oil producers’ pleas for a blanket waiver lowering the royalties they pay the federal government for crude and gas extracted from federal waters.

Still, the oil industry largely views Trump as the preferred alternative to Joe Biden, whose $2 trillion climate plan aims to end U.S. reliance on fossil fuels.

The cascade of oil-patch bankruptcies isn’t likely to stop until supply and demand come back into balance, which could take some time. Global oil demand will rebound next year as the world emerges from the coronavirus pandemic, but won’t fully recover until 2022 at the earliest, the International Energy Agency said in June.

Producers are responding to investor demands for lower spending, however, which will eventually result in a tighter oil market and higher prices, Paul Sankey, founder of Sankey Research, said in a note to investors.

“We are on the path to consumers yelling for oil companies to increase investment,” Sankey said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso