By Alex Longley

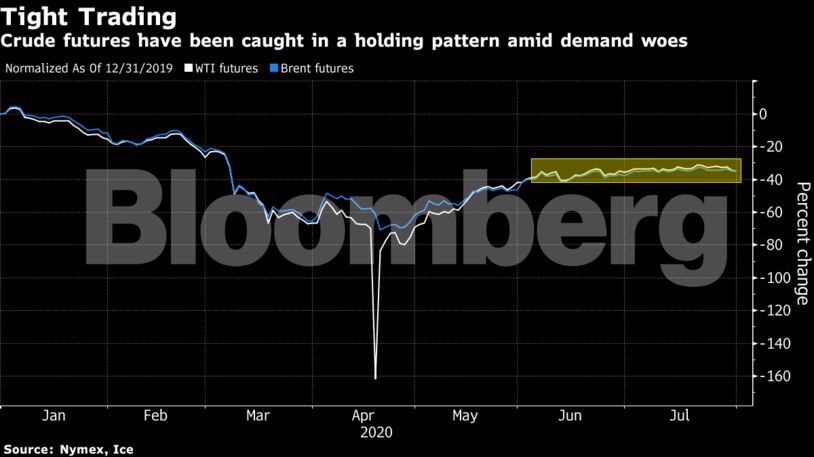

Oil has been stuck in a narrow band since June, with rising virus infections in many countries increasing concerns about a renewed hit to the global economy. It’s a precarious time for producers to be adding more supply, with Royal Dutch Shell Plc and Exxon Mobil Corp. predicting there may not be a full demand recovery until next year.

“As OPEC+ begins to raise its production, the economic outlook is still uncertain and largely tied to the evolution of Covid-19,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. “Concerns appear to be developing that a rise in OPEC+ production will coincide with an uneven recovery in oil demand.”

| Prices |

|---|

|

There’s growing evidence that the recovery in oil demand is running out of steam, JPMorgan Chase & Co. analysts including Natasha Kaneva wrote in a report. With travel indicators appearing to have stalled, there’s a chance global oil consumption could find a new normal at about 90 million barrels a day, according to the report, down from about 100 million previously.

Supply from OPEC+ will be increasing as virus cases accelerate in California, a lockdown is being reimposed in Manila, and Australia’s second-biggest city of Melbourne institutes a curfew to stem the spread. In the U.S., Marathon Petroleum Corp., the largest American independent oil refiner, said it won’t restart two of its plants in California and New Mexico amid concerns demand for fuels is unlikely to hit pre-pandemic levels this year.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein