By Saket Sundria and Alex Longley

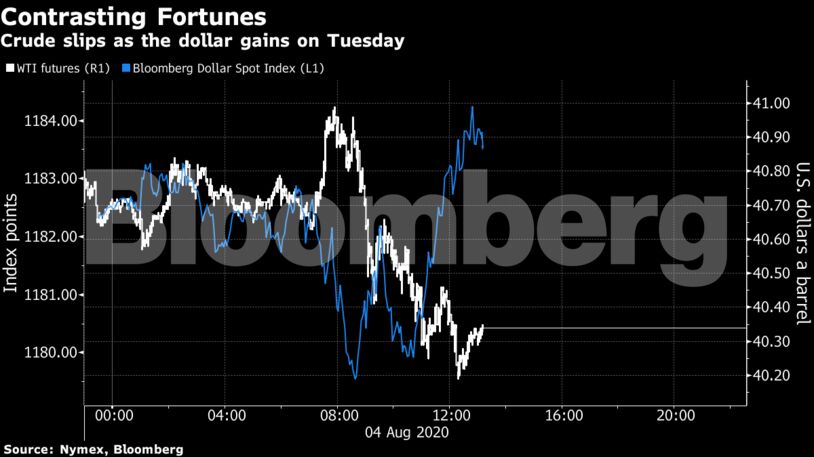

OPEC’s crude output rose last month, led by Saudi Arabia, ahead of the group and its allies relaxing their historic cuts this month, according to a Bloomberg survey. Weaker equity markets and a stronger dollar also weighed on oil prices on Tuesday.

There’s been a slew of mixed demand news this week. In Europe, airline EasyJet Plc said it would add additional flights after better-than-expected demand for travel over the summer. China’s vehicle sales jumped in July compared with the previous year, but state-owned refiner Sinopec has been processing less oil because of flooding. India’s diesel sales dropped sharply last month.

Oil has been stuck near $40 since early June as rising coronavirus cases in many parts of the world raise doubts about a sustained recovery in demand. The futures price curve is showing some weakness, with the three-month timespread for U.S. crude near the widest contango since May, indicating concerns about oversupply. That could potentially be made worse by returning output from OPEC+.

Also see: London Traders Hit $500 Million Jackpot When Oil Went Negative

“August will be a month of some price volatility,” said Paola Rodriguez Masiu, senior oil markets analyst at Rystad Energy AS. “With demand recovery stalling for a while amid Covid-19’s resurgence, supply indications will swing oil trading from gains to losses.”

| Prices |

|---|

|

The Organization of Petroleum Exporting Countries increased output by 900,000 barrels a day last month as Saudi Arabia, the United Arab Emirates and Kuwait restored additional production that was curbed in June when they amplified efforts to trim a glut. The market will also be watching this week to see if Saudi Aramco cuts the official selling price for its main crude grade for the first time since May.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS