By Kevin Crowley

More than two-thirds of the impairment was to account for the lower value of its domestic onshore acreage, with the remainder in the Gulf of Mexico and overseas, the Houston-based company said Monday in a statement. The shares plunged as much 6.8% in after-market trading in New York.

Occidental is not alone is taking large impairments after the Covid-19 pandemic crushed demand for petroleum around the world, but its writedown is one of the biggest relative to its size. Though the charges don’t affect near-term cash flows, they increase certain leverage ratios, potentially pushing up borrowing costs for the oil producer.

Excluding the writedowns, Occidental made an adjusted loss of $1.76 a share, worse than the average $1.68 estimated by analysts in a Bloomberg survey. Production came in at the high-end of Occidental’s guidance, at the equivalent of 1.41 million barrels of oil a day, boosted by output from the Permian Basin of Texas and New Mexico.

Almost every large oil and gas company has either taken or warned of massive writedowns after energy markets collapsed in the second quarter, eroding the value of their reserves. With uncertainty over when or if petroleum demand will fully recover and savage spending cuts, the industry is effectively saying large portions of its oil in the ground may never be economically produced.

Company |

Writedown |

| Shell | $16.8 billion |

| BP | $11.8 billion (excluding exploration) |

| Total | $8.1 billion |

| Occidental | $6.6 billion |

| Chevron | $4.4 billion |

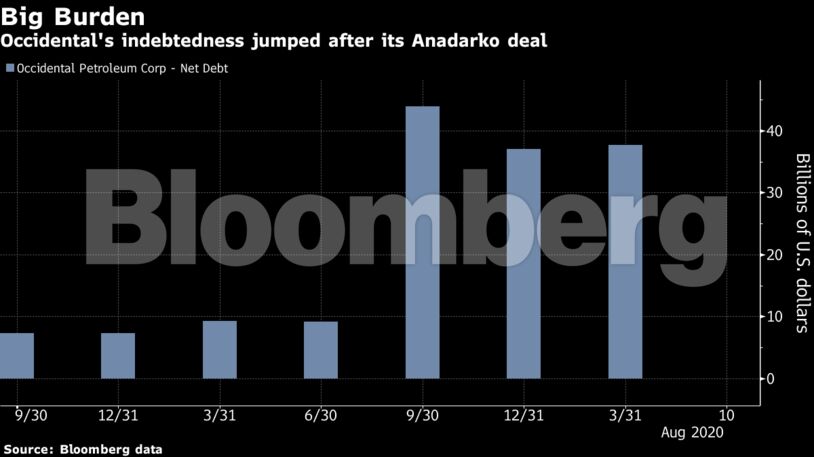

The loss heaps further pressure on Occidental, which is struggling with a $40 billion debt burden after its ill-timed purchase of Anadarko Petroleum Corp. last year. The company is currently considering selling assets to pay down the debt and expects to receive some $2 billion from sales in the near-term, it said in a presentation on its website.

To cope with the collapse in oil prices, Occidental has been in full-blown retreat, slashing its capital budget by more than half to $2.5 billion for the year. That’s below the $2.9 billion per year it needs to sustain production going forward. As such, output is declining quickly, with a 13% drop to 1.23 million barrels a day expected in the current quarter and a further 5% in the fourth.

The company said it plans to only operate one rig in the Permian Basin for the rest of the year and none in the Rocky Mountains, a stark contrast to the growth plans envisaged when it outbid Chevron to buy crosstown rival Anadarko last year.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire