By Brian Eckhouse

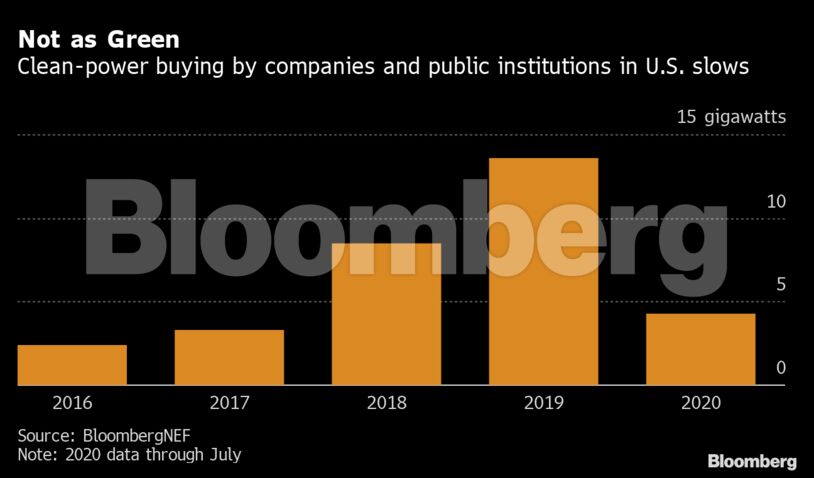

Renewable power contracted by U.S. corporations and public institutions this year will probably fall short of last year’s record-high 13.6 gigawatts, according to a report Tuesday by BloombergNEF. Through July, procurement of clean energy stood at 4.3 gigawatts, down from 6 gigawatts at that point last year.

The slump comes as corporations and public institutions — recent drivers of renewables’ growth in the U.S. — are using less energy and rethinking their carbon footprints with the pandemic forcing more people to work at home rather than in offices.

“It becomes difficult to scope out the magnitude of a clean-energy commitment if a company doesn’t know what their footprint will look like short- and long-term,” said Kyle Harrison, an analyst at BNEF, in an email.

Then there’s the matter of power demand. Sluggish demand and changing consumer activity has hurt the outlook on long-term power prices, adding to buyer apprehension, Harrison said. Texas — historically America’s biggest corporate market — saw just 940 megawatts of deals this year through July after 5.5 gigawatts was done last year.

Globally, corporations and public institutions agreed to 8.9 gigawatts of power-supply agreements in the first seven months of this year, slightly ahead of the 8.6 gigawatts signed through that point last year, according to BNEF. Latin America, Taiwan and Australia in particular are seeing bursts of deals. But it will take continued global activity to make up for the decline in the U.S., the largest corporate market.

“A drop in U.S. activity could be a harbinger for drops in activity elsewhere long-term,” Harrison said. “A return to form will be important to set an example for how corporations in the rest of the world should be buying clean energy.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS