By Naureen S. Malik and Heather Perlberg

Representatives for Blackstone and Brookfield declined to comment.

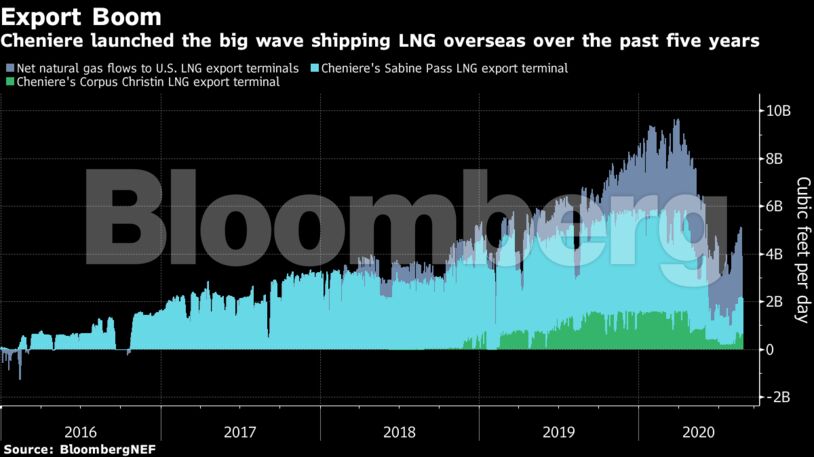

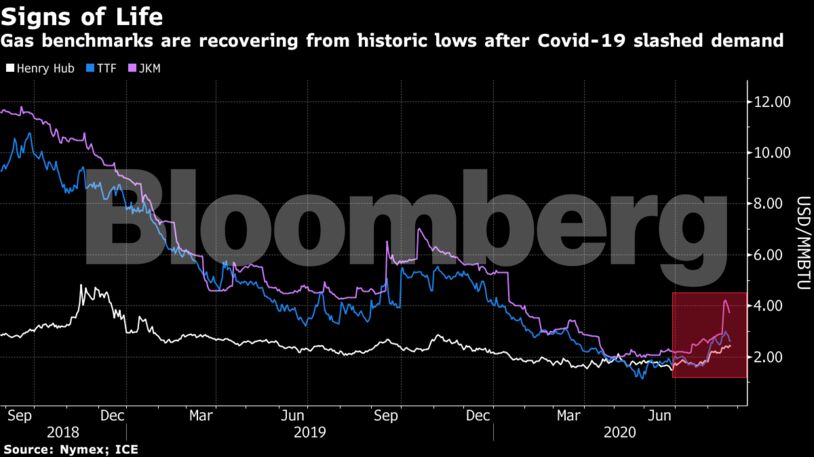

The infrastructure funds are betting on Cheniere to continue to thrive amid short-term challenges to U.S. LNG exports. The Houston-based terminal operator is generating $4.3 billion annually from Sabine Pass and a smaller terminal in Texas through its fixed-fee contract structure, protecting it from the collapse in prices after the Covid-19 pandemic and a mild winter hammered consumption.

While global demand is returning seasonally, the long-term outlook for the fuel is also positive with more nations switching to gas from coal amid concerns about climate change.

Bloomberg News first reported discussions around Brookfield’s infrastructure group acquiring a minority position in Cheniere Energy Partners earlier this month. The firm reported an initial investment in 2016 and as of June had accumulated a 0.34% holding.

Blackstone Energy Partners made a $1.5 billion investment in 2012 in Cheniere Energy Partners, which was created by Cheniere Energy Inc. to develop the $25 billion Sabine Pass LNG terminal in Louisiana. That project, which is underpinned by 20-year contracts with major global traders and utilities, shipped its first cargo in February 2016.

More than 85% of the production volume at Sabine Pass is contracted and is expected to earn about $3.3 billion in fixed fees annually by the time the sixth liquefaction unit starts up in less than three years.

Brookfield’s investment in Cheniere also comes after the asset manager purchased a 25% equity interest in Dominion Energy Inc.’s much-smaller Cove Point LNG terminal in Maryland for about $2.1 billion. This summer, Warren Buffett’s Berkshire Hathaway also bought a 25% stake and took over operations at Cove Point as part of a $4 billion deal for Dominion gas assets.

For Blackstone’s public shareholders, the sale is expected to generate distributable earnings of $0.16 per share, including $0.13 a share upon closing expected in the third quarter, the people said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire