By Reed Stevenson

Chief Executive Officer Elon Musk has ignored or broken many of the established auto industry’s rules and norms in the 10 years since he took Tesla public, selling cars online and assembling vehicles in high-cost California. But while his company’s value has soared, there remains a gulf in the scale of his company and the world’s biggest car manufacturers.

Tesla produced 103,000 vehicles in the first quarter, or about 4% of the almost 2.4 million made by Toyota, which built its brand on affordability and reliability backed by innovations in large-scale manufacturing.

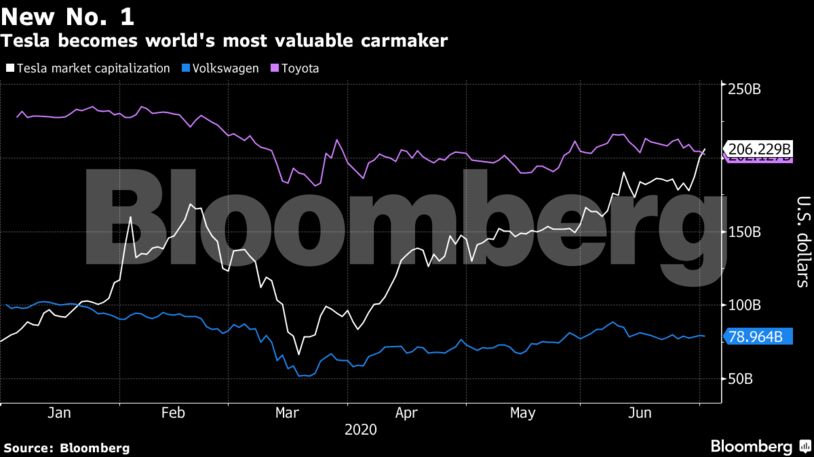

Tesla became the world’s second-most valuable automaker in January, when it surpassed Volkswagen AG. It’s now worth more than twice the German giant.

After pioneering gas-electric vehicles with the Prius hybrid, Toyota was late to shift to fully electric autos and has wagered heavily on hydrogen fuel cells. The company is now making a series of high-profile investments in EVs and self-driving cars. The manufacturer has forecast an 80% plunge in profit this year and expects it could take until the first half of next year before the auto market recovers to pre-pandemic levels.

Toyota’s market valuation includes the 14.3% of shares that Toyota itself holds as treasury stock, worth around $30 billion. Tesla doesn’t hold any treasury shares, according to data compiled by Bloomberg.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein