By David Wethe

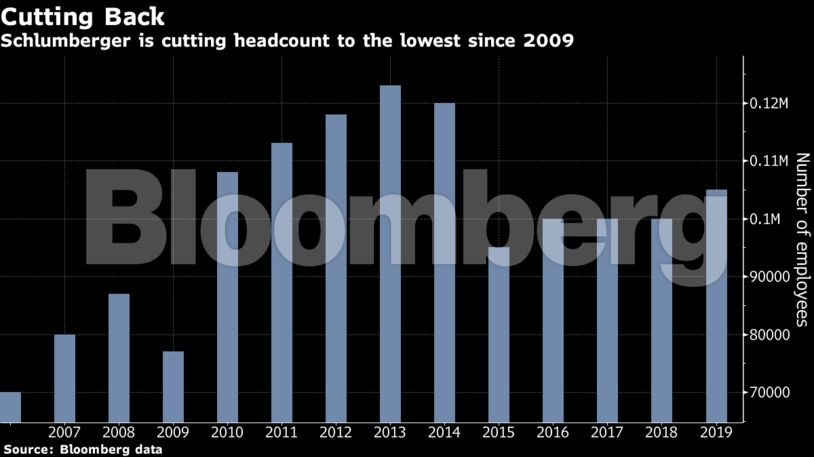

The second-quarter rout was so bad for Schlumberger that it’s spending $1 billion on job severance in a move that will shrink staffing to an 11-year low. Various restructuring and impairment charges cost it another $2.7 billion, the company said Friday in a statement.

“This has probably been the most challenging quarter in past decades,” Chief Executive Officer Olivier Le Peuch said in the statement. “Subsequent waves of potential COVID-19 resurgence pose a negative risk to this outlook.”

Despite disastrous results in some business lines — North American onshore fracking and other sales tumbled 60% from the previous quarter’s level — Le Peuch shielded the 12.5-cent-a-share dividend from additional reductions. Just three months ago, the CEO reduced the payout for the first time in more than 40 years.

Beating Forecasts

Schlumberger shares rose 1.2% to $19.54 at 7:50 a.m. in New York after earlier dropping as much as 3.6%. Adjusted earnings of 5 cents a share outperformed the penny loss expected by analysts in a Bloomberg survey.

More than 21,000 workers are being let go, according to the statement. Schlumberger employed 105,000 as of the end of 2019.

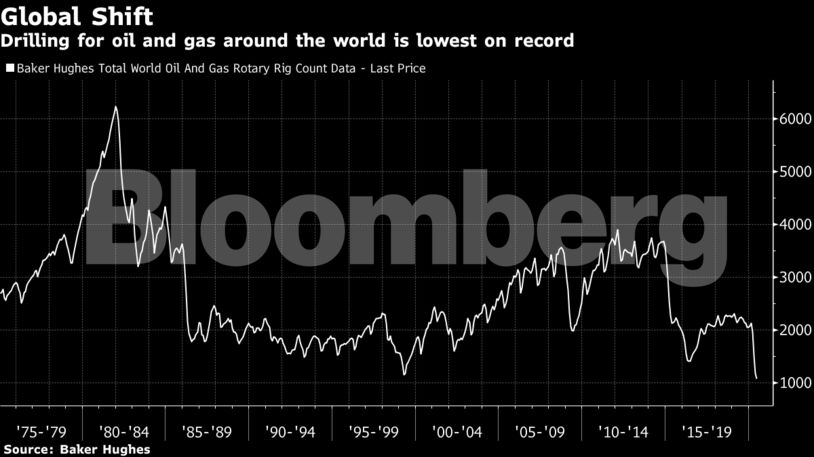

The hired hands of the oil patch who map underground pockets of crude and drill new wells have seen some of the worst pain since the global pandemic first began to wreck energy markets. The number of wells drilled worldwide this year is expected to drop by almost a quarter, with no forecast of a full recovery in the coming years, according to industry consultant Rystad Energy.

Schlumberger is the last of the big three oil service companies to report second-quarter results. Halliburton Co. impressed investors with better-than-expected cost cuts while announcing a new strategy to role out more technology and look internationally for better revenue growth. Baker Hughes Co. warned investors of a possible second wave of coronavirus cases leading to lockdowns again.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet