By Saket Sundria and Alex Longley

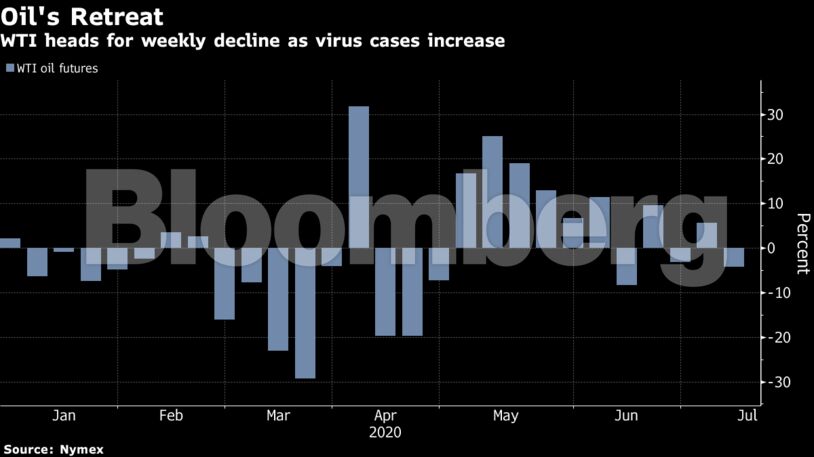

Futures slipped to near $39 a barrel in New York, and are down 4% this week. The IEA said oil demand is rebounding, but that’s at risk from a resurgence in the virus across major economies. Supply could also become more abundant as Libya’s National Oil Corp. announced it would lift force majeure on all exports following months of near-zero shipments.

The rally in crude driven by the easing of lockdowns has stalled near $40 a barrel as traders weighed the resulting acceleration of infections. California, Texas and Florida have recorded some of their biggest daily gains in cases and deaths this week. There’s a growing risk that the renewed outbreaks will impede efforts to reopen the economy.

“America is still in the throes of the pandemic and this spells bad news for the oil demand outlook,” said Stephen Brenock, an analyst at brokerage PVM Oil Associates. “Against this backdrop, upside potential for oil prices will remain in short supply.”

Oil refineries in Texas are now having to grapple with Covid-19 outbreaks. Marathon Petroleum Corp.’s Galveston Bay plant has well over 100 confirmed cases, while at least four other refineries have workers who’ve tested positive.

| Prices |

|---|

|

See also: Revival of Libya’s War-Torn Oil Industry to Be Slow and Costly

With Libya lifting force majeure — a legal status protecting a party if it can’t fulfill a contract for reasons beyond its control — the African country may be able to resume shipments halted by a prolonged blockade of fields and ports. Nevertheless, the country’s national oil company warned that technical issues at oil deposits, pipelines and terminals would keep production low.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein