By Low De Wei and Alex Longley

Futures in New York dropped below $41 a barrel. Saudi Arabia and Russia said the producer bloc would proceed with its plan to add more supply next month and were confident that it wouldn’t hurt oil’s rally, with the tapering to be offset by extra cuts from countries that didn’t meet their targets.

Oil was also under pressure from a drop in equities in Europe and Asia. That was despite figures that showed China’s economy returned to growth and expanded more than forecast last quarter.

The recovery in China is in stark contrast to other corners of the globe, where the coronavirus continues to rage out of control. That’s leading to a patchy rebound in crude, though there are pockets of strength in some parts of the oil market, with North Sea contracts trading at their strongest levels in five months. All of that has left headline prices struggling to break far beyond $41.

“Unless the market makes a convincing jump today, those with bullish inclination will become disillusioned and the recent highs will not be challenged in the near future,” said Tamas Varga, an analyst at brokerage PVM Oil Associates.

| Prices: |

|---|

|

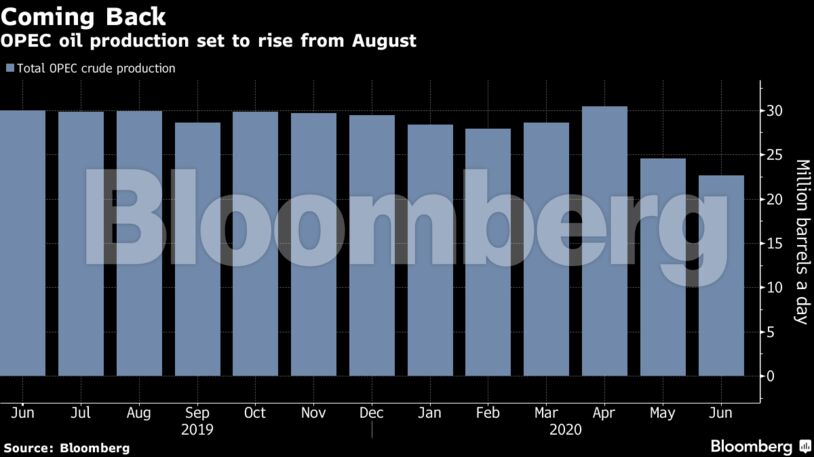

The Organization of Petroleum Exporting Countries and its allies will withhold 7.7 million barrels a day from the market in August, compared with 9.6 million currently. The actual cut next month will be 8.1 million to 8.3 million barrels a day due to the compensatory curbs from members including Iraq and Nigeria.

See also: U.S. Gasoline Stocks Mirror Nation’s Fractured Pandemic Response

There were also signs that supplies from Russia will remain low, at least in the short-term. It will ship three cargoes of Urals crude from its Baltic ports in the first five days of August, down from five a month earlier, according to a loading program. Urals loadings were planned at the lowest in a decade for July.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS