By Sharon Cho and Rakteem Katakey

Infections flared by a record in Hong Kong, and Los Angeles is on the brink of another stay-at-home order. New cases have accelerated in California, although the pace of deaths slowed in Arizona and Florida. The concerns were reflected in equity markets as well with stocks lower in Europe.

“Risk-off environment as gauged by falling equity markets is not helping oil today,” said Giovanni Staunovo, a commodities analyst at UBS Group AG. “The stalling oil demand recovery story is also not helping. The virus continues to remain a demand concern until a vaccine is found.”

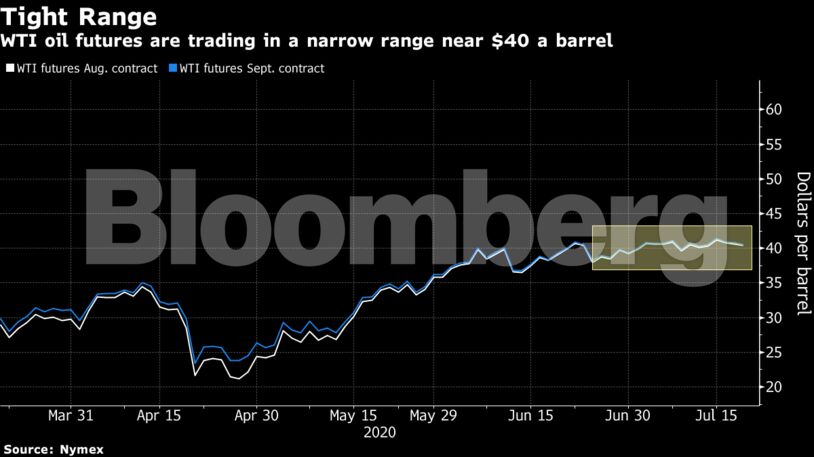

Oil has been stuck in a tight range this month after rebounding sharply from a plunge below zero in April. There are wide-ranging concerns as the pandemic is accelerating again in parts of the world and threatening demand, while OPEC+ is preparing to ease its record supply cuts starting next month. But, Russia is signaling it’s serious about using any extra supply locally and won’t send it to key refining markets like northwest Europe.

| Prices: |

|---|

|

While Russia’s oil export plan is still not finalized, shipments of Urals crude in August are likely to be broadly in line with this month’s levels, according to people familiar with the matter. That would be consistent with a loading plan for the first five days of August, and comments from Energy Minister Alexander Novak that increased oil production is going to be used internally.

Meanwhile, oil explorers in the U.S. last week extended a record streak of rig retirements that commenced four months ago with a Saudi-Russian price war and the virus-driven demand collapse.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS