By Joanna Ossinger

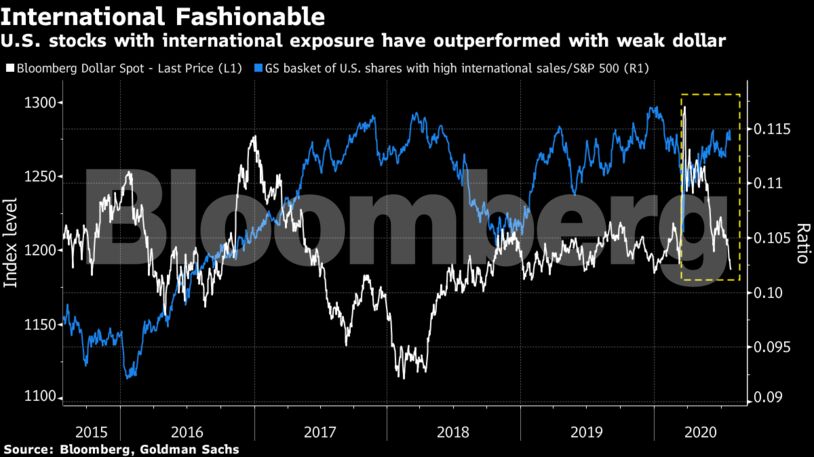

Shares of U.S. firms with high revenue exposure to Western Europe and the BRIC countries — Brazil, Russia, India and China — also fare well in weaker-dollar environments, wrote strategists including David Kostin in a note Friday. Goldman’s FX strategists see the trade-weighted dollar depreciating by more than 5% over the next 12 months, they said.

“During months when the trade-weighted dollar fell by at least 1.25%, the international-facing information technology and energy sectors have performed best while the more domestic-facing consumer discretionary sector has performed worst,” they wrote. “When the dollar weakens, investors should favor firms with a larger share of revenues generated abroad.”

The dollar fell to its lowest since January on Friday as investors bet the Federal Reserve will remain accommodative in its policy when it meets this week, and the economic health of the rest of the world would pick up relative to the U.S., as coronavirus cases continued to climb there. Investors are now lining up to short the greenback.

The Goldman strategists also found that purchases of U.S. equities by foreign investors increase when the dollar weakens, in an analysis of data going back to 1980. Goldman expects foreign investors to buy $300 billion of American stocks this year.

“A weakening U.S. dollar has historically been the biggest catalyst for foreign investor demand for U.S. stocks,” they said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein