By Javier Blas and Grant Smith

The Organization of Petroleum Exporting Countries will meet by video conference on Saturday at 1 p.m. London time, followed by a conference with their OPEC+ allies two hours later, delegates said. The agreement, once ratified, will extend the record OPEC+ production curbs for another month until the end of July, instead of easing them as previously planned.

Brent crude advanced as traders anticipated a tighter market in the coming months. The international benchmark was poised for a sixth weekly advance, rising 3% to $41.21 a barrel as of 11:10 a.m. in London.

“We’re reasonably optimistic on the outlook for oil in the second half of the year,” Isabelle Mateos y Lago, co-head of the official institutions group at BlackRock Inc., said in an interview with Bloomberg television. “Demand is likely to recover far more quickly than supply.”

Prices Doubled

OPEC+ is used to dramatic glitches endangering deals at the last minute, so delegates said nothing would be agreed until formal communications take place. If it accepts stricter terms, the Iraqi government risks a backlash from parliamentarians and rival political parties by acceding to foreign pressure.

Still, members of the 23-nation OPEC+ alliance have a lot to gain by preserving their agreement, which has helped engineer a doubling in Brent prices since April. That has eased pressure on the budgets of oil-rich nations, while also reviving the fortunes of major energy companies like Exxon Mobil Corp. and Royal Dutch Shell Plc.

Failure to reach an agreement this month could have brought millions of barrels of oil onto the market, undermining a tentative recovery as countries start emerging from coronavirus lockdowns. With U.S. shale production starting to come back online, OPEC’s careful management of the demand recovery is crucial.

Saudi Arabia and Russia, who were on opposite sides of a vicious price war until a peace deal in April, are now united against those in OPEC+ who have consistently failed to shoulder their share of the burden. Moscow, a habitual laggard, has complied punctiliously with the historic accord brokered by President Donald Trump, and wants to make sure others do too.

“Reunited in leadership of OPEC+ and grimly facing many more months, if not years, of oversupply, Russia and Saudi Arabia had little to lose and much to gain by imposing concrete measures to improve compliance by the laggards, especially Iraq,” said Bob McNally, founder of consultant Rapidan Energy Group and a former White House official.

The details of the deal between OPEC+ and Iraq on compliance were still not clear early on Friday. Tough conditions will be difficult to accept for a country still rebuilding its economy following decades of war, sanctions and Islamist insurgency.

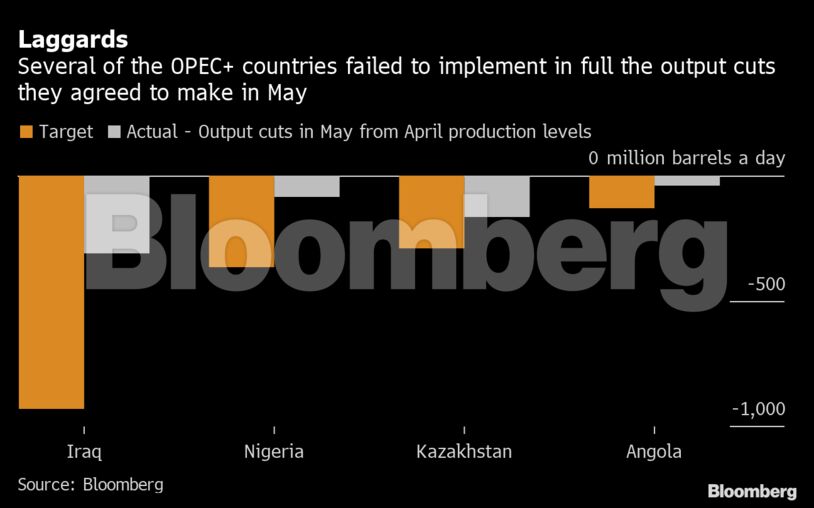

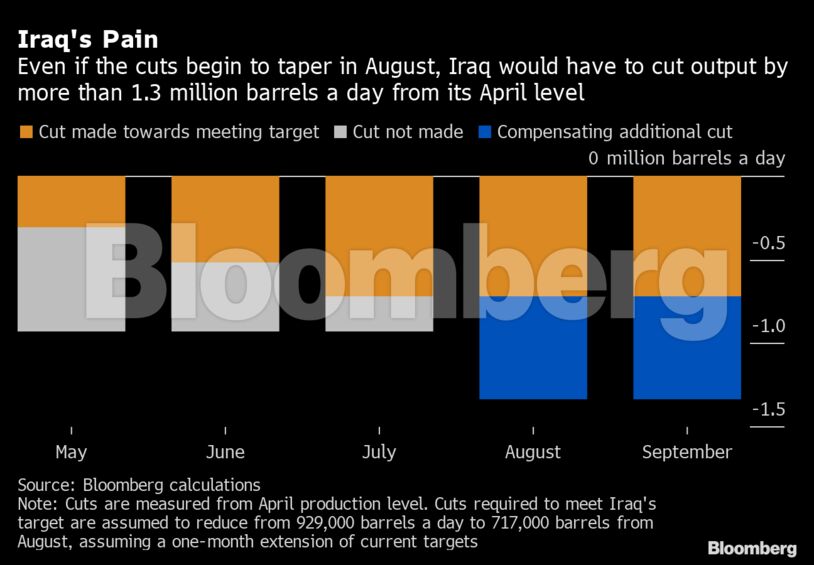

Iraq made less than half of its assigned cutbacks last month, so compensating fully would require it to slash production by a further 24% to about 3.28 million barrels a day, according to Bloomberg calculations. That would be a tall order.

Three other nations — Angola, Kazakhstan and Nigeria — also produced above their OPEC+ quotas in May. The three pledged on Thursday to bring their output in line with the agreement.

The Deal

Enforcing better compliance among OPEC+ nations has been a motif since Saudi Energy Minister Prince Abdulaziz bin Salman was appointed.

In his first public outing after becoming energy minister, in Abu Dhabi last September, the prince was literally applauded for securing loud pledges of atonement from Iraq and Nigeria.

His tenure has also been stormy. In March, the prince’s attempt to force Russia to make deeper output reductions backfired spectacularly, splintering the entire alliance and igniting a destructive price war.

Two months ago, Prince Abdulaziz’s achievement in successfully restoring the OPEC+ coalition and forging an agreement for historic production cuts was overshadowed — and delayed — by a spat over Mexico’s contribution.

The final deal in April set out historic cuts of 9.7 million barrels a day, or roughly 10% of global oil supplies, to offset the unprecedented collapse in demand caused by the virus lockdowns. Then a few weeks later, Saudi Arabia and its closest allies in the Persian Gulf promised additional supply restraint of 1.2 million barrels a day in June.

If a new accord is signed this weekend, the impact on the oil market could be dramatic. After the massive oversupply earlier this year, Russian Energy Minister Alexander Novak predicts there could be a production deficit of 3 million to 5 million barrels a day next month, Interfax reported. That’s roughly in line with projections from an OPEC committee that met on Wednesday, a delegate said.

That would provide a stronger foundation for the crude price recovery, and also allow the cartel to start chipping away at the billion-barrel stockpile that’s built up during the crisis.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso