By Elizabeth Low and Alex Longley

Futures earlier slumped 2.4%, but pared losses as the European Central Bank boosted stimulus measures.

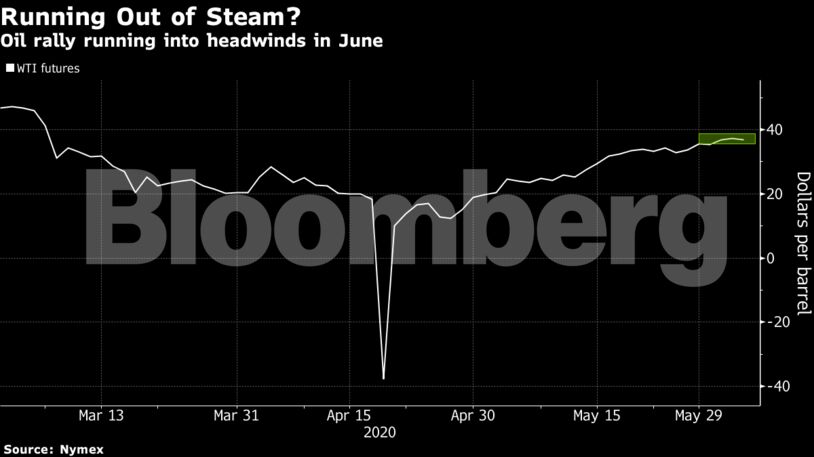

While oil prices have rebounded rapidly since mid-April, the rally is faltering amid gathering headwinds. The White House is suspending passenger flights to the U.S. by Chinese airlines as relations between the two leading economies deteriorate, while civil unrest across America is complicating the economic recovery from the coronavirus and risking a second wave of infections.

Sluggish Demand

U.S. diesel demand fell to a 21-year low last week and gasoline stockpiles swelled, according to Energy Information Administration data. The figures suggest that fuel consumption in the world’s largest oil consumer isn’t recovering as quickly as previously anticipated, and other countries continue to see demand languishing.

“There is still a huge surplus, demand is not back to where it was before,” Norwegian Energy Minister Tina Bru said in a Bloomberg Television interview. Nevertheless, “we’re seeing good signs in the market that it’s moving toward a stabilization a little quicker than the worst fears.”

| Prices: |

|---|

|

The timing for a meeting between the Organization of Petroleum Exporting Countries and its allies, planned for this week or next, remains unclear as disagreements between members persist. Amid the uncertainty, Saudi Arabia has delayed its July crude pricing until Sunday at the earliest, according to people with knowledge of the situation.

“It’s not an easy exercise for OPEC to balance the market,” said Olivier Jakob, managing director of consultants Petromatrix GmbH. The Saudis likely realize “they need to be careful about not helping the U.S. crude oil to come back too quickly.”

Higher prices have already spurred some U.S. producers to bring wells back online. EOG Resources Inc. and Parsley Energy Inc. are preparing to ramp up output just weeks after turning off the taps.

| More oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS