By Alex Longley and James Thornhill

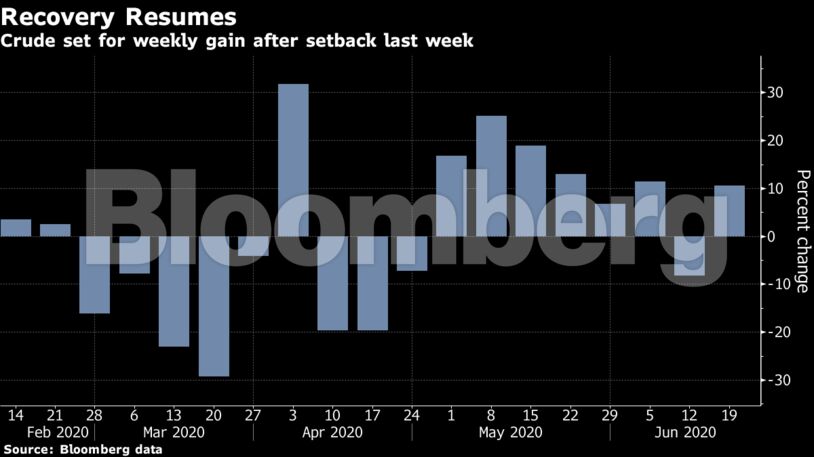

Futures in New York traded above $40 a barrel on Friday and are up about 11% this week. Oil traders Vitol Group and Trafigura Group and exporter Saudi Aramco all talked up the strength of the demand recovery in recent days, and prices for some of the world’s major oil products have begun to roar higher.

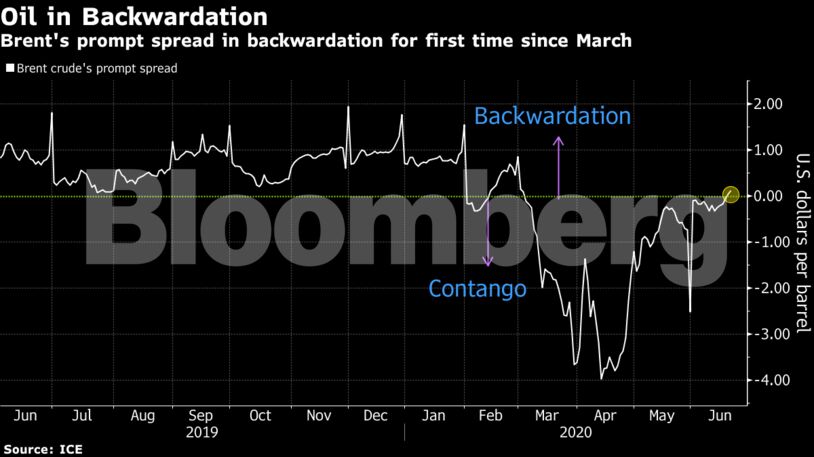

Gasoline futures in the U.S. moved into backwardation for the first time in three months on Thursday, a bullish signal indicating supplies are tightening as the summer driving season gets under way. Meanwhile, swaps in the North Sea market that prices much of the world’s crude jumped on Thursday as traders posted several bids for cargoes but only one willing seller emerged.

Though the outlook for crude has brightened in recent days, a potential resurgence of the virus is clouding the long-term outlook. Traffic in Beijing has plunged as authorities battle a fresh outbreak, while some U.S. states are still seeing cases surge. Still, OPEC+ gave reassurance on output cuts on Thursday, finalizing a deal with Iraq — a habitual quota cheat — to compensate for overshooting its production target in May.

“OPEC+ has done a good job turning things around and stronger demand also helps,” said Carsten Fritsch, an analyst at Commerzbank AG.

| Prices: |

|---|

|

Apart from the virus, the other major threat to oil prices comes from suppliers re-opening shuttered production too early. U.S. producer Continental Resources Inc. said Thursday it will start bringing back some of its idled oil output next month, but will keep about 50% curtailed.

Equities Climb

Crude also got a boost Friday from equity markets in Europe and the U.S., which gained following the latest breakthrough in trade negotiations between America and China and stimulus talks in Europe. Crude has been embroiled in equity-market sentiment for much of this week.

“Oil prices find a lot of support in line with equity markets,” said ABN Amro’s senior energy economist, Hans van Cleef. “Risk-on mode is supportive for commodities.”

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Trump’s Big Bill Shrinks America’s Energy Future – Cyran