By Elizabeth Low and Alex Longley

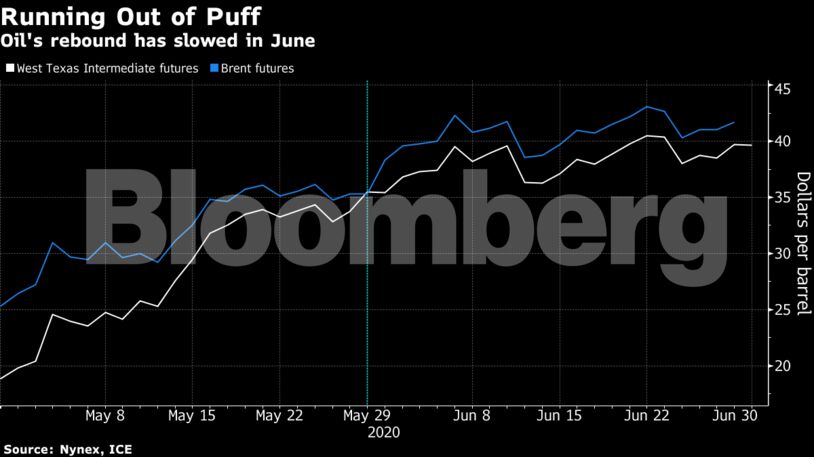

Futures in New York fell 1.3% toward $39 a barrel. With the coronavirus running rampant across southern and western America and many states pausing or reversing reopening measures, the outlook for energy demand in the world’s largest economy remains uncertain. Oil prices are also being put under pressure by the prospect of returning supply from Libya.

Though prices are heading for a 10% gain this month and the market is in much better shape than a couple of months ago, global consumption is still a long way off pre-crisis levels. Gasoline demand in the U.S. is under threat again with the virus restraining public activity. Royal Dutch Shell Plc painted a bleak picture of the industry as it forecast billions of dollars of asset writedowns.

“We still believe it is difficult to justify significant upside in prices in the near term due to the high levels of inventory, continued weakness in refinery margins and the fear over a severe second wave of Covid-19,” said Warren Patterson, head of commodities strategy at ING Bank NV.

| Prices: |

|---|

|

OPEC and its allies have successfully curbed production, and helped the market toward some balance. But returning production from Libya could partially throw that into disarray. Tribes in the country’s east backed the restart of oil output, and the state energy company said negotiations between the U.S. and regional governments could lead to a resumption of exports from the war-battered OPEC member.

Still, in a bright spot for the oil market, China’s recovery is continuing with manufacturing data for June beating estimates. The country’s state-owned refining giants are in talks to form a joint purchasing group to buy crude, a move that has the potential to alter the balance of power between buyers and sellers in the oil market.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS