By Sharon Cho and Alex Longley

Crude in New York has surged about 80% in May, clawing back the declines of the previous two months. The physical market has also recovered in recent days. Indian, Chinese and South Korean refineries are buying distressed cargoes in a sign of returning demand.

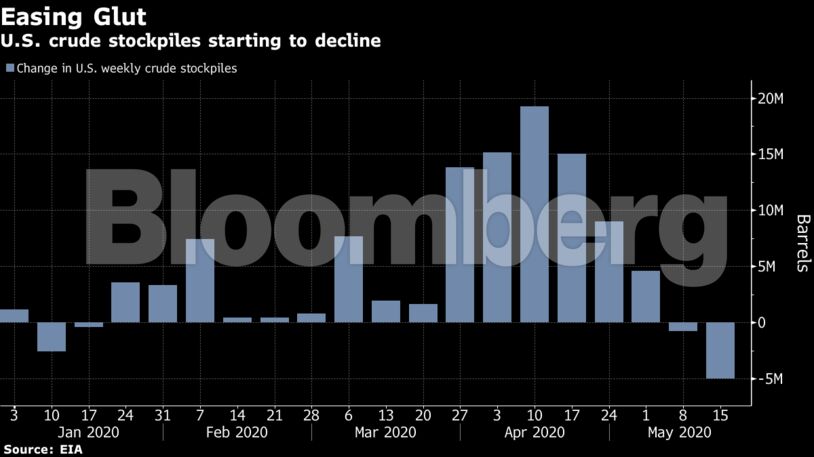

OPEC and its allies agreed to reduce output by almost 10 million barrels a day from this month in an effort to drain a worldwide glut brought on by the collapse in demand amid the coronavirus outbreak. As part of that deal, cuts would slowly taper from July. Russia plans to stick with those terms, people familiar with the matter said.

“At this stage there are two only variables that are able to significantly move prices,” said Rystad Energy’s head of oil market analysis, Bjornar Tonhaugen. “Hints on the direction at the coming OPEC+ meeting and the consensus that will be reached, and the rate of the shut production’s reactivation.”

| Prices |

|---|

|

Despite the boost in demand and optimism over economies recovering, there are some warning signals. Demand for gasoline fell 25% to 35% from a year earlier over the U.S. Memorial Day weekend, which heralds the start of the summer driving season and the peak of fuel consumption. Profits for making the fuel dropped below $10 a barrel for the first time in about two weeks on Wednesday.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein