By Paul Burkhardt and Elizabeth Low

There was also more evidence demand is starting to come back in the U.S. Gasoline supplied, an indicator of consumption, rose by the most in almost two years last week, while Genscape Inc. reported that stockpiles at the storage hub at Cushing, Oklahoma have fallen since last Friday, which would be the first contraction since late February if confirmed by government data.

While there’s still a substantial glut to clear, the numbers are prompting optimistic assessments from some influential energy analysts. Global oil demand is on an “improving trajectory” and may exceed supply by the start of June, said Jeffrey Currie, head of commodities research at Goldman Sachs Group Inc. The market will return to balance in July before moving into excess consumption for the rest of the year, according to Standard Chartered Plc.

The “massive” price hikes by Saudi Arabia “show the willingness to bury the hatchet with Russia in the price war,” said Eugen Weinberg, Commerzbank AG’s head of commodity research. Recent gains in the market are largely due to a combination of higher risk appetite and expectations for stronger demand, he said. “We consider the price increase overdone, however.”

U.S. benchmark crude needs to be capped at about $25 a barrel to force producers to curtail output, according to Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. That price level keeps supply from overwhelming capacity at Cushing.

“You need to make sure that production declines, to avert the containment issue at the storage hub,” he said.

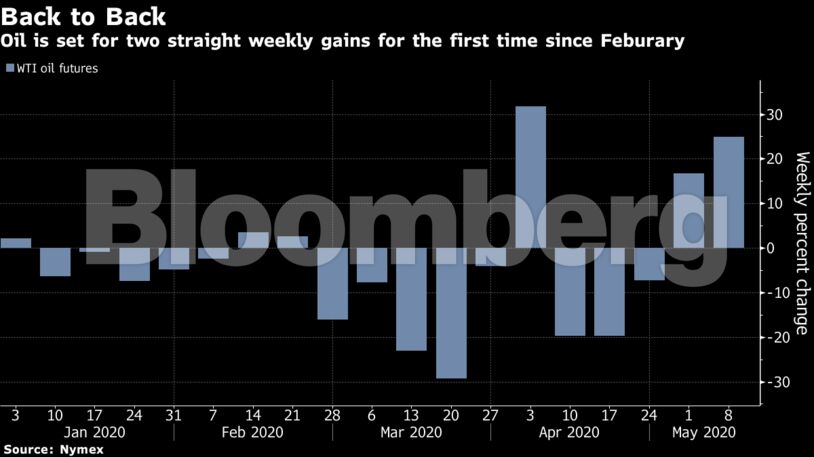

West Texas Intermediate for June delivery rose 1.4% to $23.87 a barrel on the New York Mercantile Exchange as of 12:47 p.m. in London after closing down 1.8% on Thursday. Brent for July settlement added 1.2% to $29.82, taking its advance so far this week to around 13%.

While the Saudi pricing announcement brought relief to the market, a robust increase in demand will be needed to sustain higher prices. The kingdom began curbing production in late April as part of the OPEC+ deal, but still exported record amounts of crude last month. The level of excess global supply averaged 21.3 million barrels a day in April, according to Standard Chartered.

U.S. weekly gasoline supplied rose by 804,000 barrels a day last week, the biggest jump since June 2018, according the Energy Information Administration. The fuel’s premium to diesel climbed to the highest since 2017.

Genscape reported on Thursday that stockpiles at Cushing have fallen by 350,000 barrels since last Friday, according to market participants.

| More oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS