By Elizabeth Low and Alex Longley

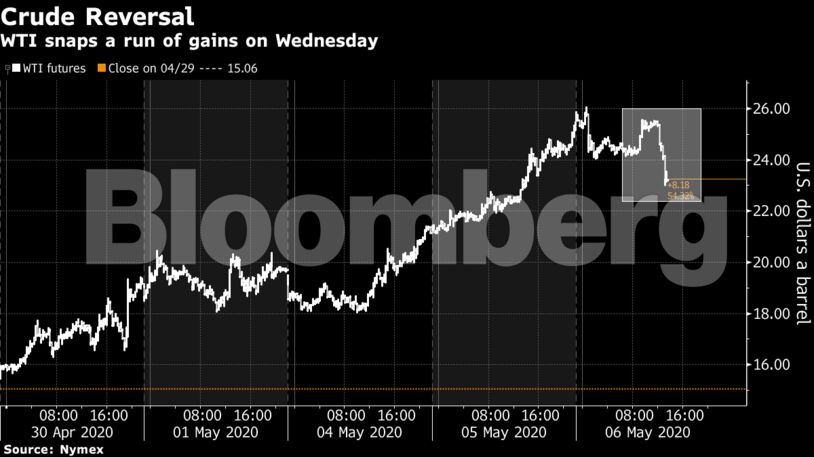

The drop reflects persistent concern that the global glut will take a long time to eliminate as demand remains crushed by the coronavirus. Economic data also weighed on prices, with the U.S. losing a record number of jobs in April and the European Union predicting steep contractions across the region.

Crude’s collapse has forced countries across the world to rein in oil production. Russian output was down 16% in the first five days of May, Interfax reported, while in the U.S., Plains All American Pipeline LP said it sees close to 1 million barrels a day of Permian shut-ins in May.

Though supply is falling, the extent of the damage to the global economy is becoming clearer. The European Commission said Italy, Spain and Greece are all facing contractions of more than 9% this year, while ADP Research Institute figures showed the U.S. lost more than 20 million jobs last month.

Most analysts don’t see demand rebounding to pre-virus levels for at least a year, with some questioning if that will ever happen. The risk of a second wave of infections in the U.S. as states reopen can’t be discounted, while deteriorating relations between Washington and Beijing may hamper the global economic recovery.

| Prices: |

|---|

|

“We’ve gone on Brent from $20 to $32, that’s a lot,” said Tor Svelland, chief executive officer of commodities fund Svelland Capital. “The demand destruction is still there, it’s a very, very strong move.”

U.S. crude stockpiles rose by 8.44 million barrels last week, the American Petroleum Institute reported, according to people familiar with the data. That would be the smallest increase since the week ended March 20, if confirmed by Energy Information Administration figures due later Wednesday. Supplies at the storage hub at Cushing, Oklahoma, expanded by 2.68 million barrels, the API data showed.

| More oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein