By Ann Koh and Alex Longley

Futures in New York for July delivery gained to above $32 a barrel. A report that a virus vaccine study didn’t produce enough critical data to assess its success added some caution to markets, which have been buoyed by a rebound in demand and sharp reductions in supply. Data in the U.S. and Europe pointed to declining stockpiles.

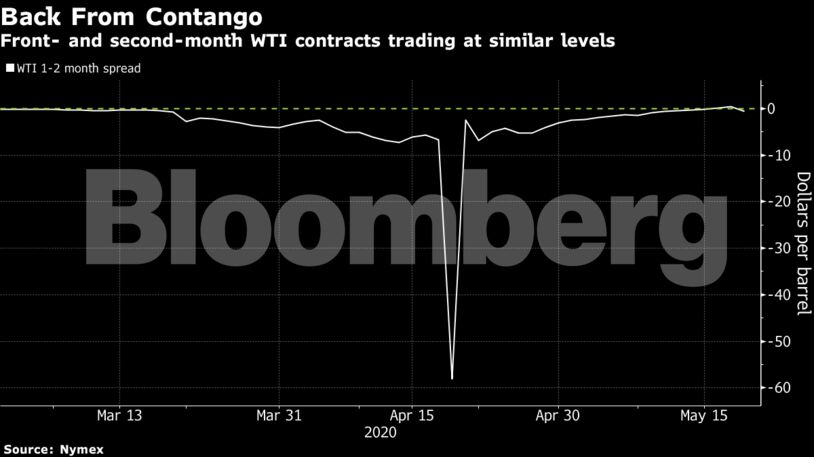

The oil market is in much better shape than it was a month ago as output cuts have kicked in and pockets of demand have emerged. There was no repeat of April’s plunge below zero when the West Texas Intermediate contract rolled over, with the June futures trading at a premium to July before they expired, suggesting concerns the U.S. would run out of storage have eased.

“Demand is now clearly on its way back from extremely low levels in April,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “The direction for oil is most likely still higher from here.”

| Prices: |

|---|

|

In more evidence the supply response to the virus is gathering pace, the American Petroleum Institute reported stockpiles at the storage hub at Cushing, Oklahoma, fell by 5.04 million barrels last week, people familiar with the data said. U.S. crude inventories dropped by 4.84 million barrels, the API said. The official Energy Information Administration figures are due later on Wednesday.

Still, any continued rally in oil could be self-defeating as it would encourage output to return when demand is still shaky, UBS AG said in a note.

| More oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso