By Alex Longley and Saket Sundria

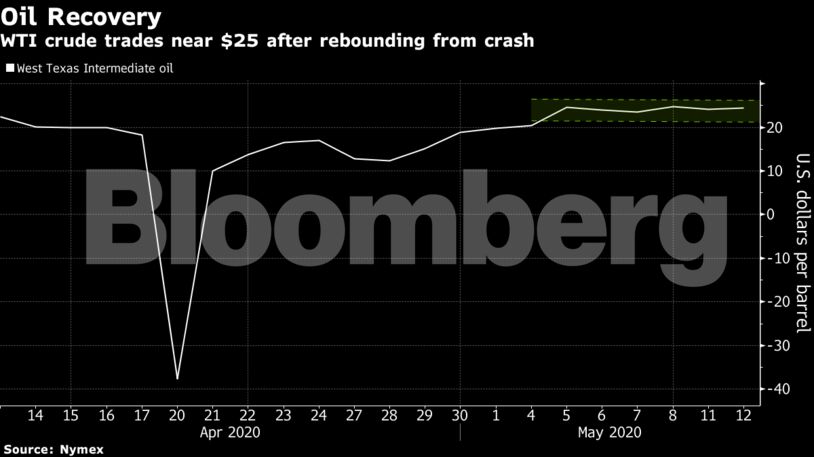

Oil is still down about 60% this year with little clarity about when, and if, global consumption will return to pre-virus levels. There’s been a steady recovery in air and road travel in China’s biggest cities, but in Europe various degrees of lockdown continue to hobble consumption. In the U.S., fuel sales at gas stations rose during the week to May 2, but are still far below 2019 levels. The threat of a resurgence of the virus remains high.

“The road to an oil price recovery will likely be choppy and plagued with stop-and-go rallies and selling cycles until some level of price certainty is restored,” said Roger Diwan, vice president of financial services at IHS Markit.

| Prices |

|---|

|

Indian fuel consumption this month is expected to be as much as 25% higher than April as trucks and other traffic return to the road with restrictions easing, according to officials at two state-owned refineries. In China, more people are driving to avoid public transport due to virus fears, boosting gasoline demand.

See also: Saudis in ‘Whatever It Takes’ Mode to Fast-Track Recovery: RBC

Prices have also got a boost this month with the Organization of Petroleum Exporting Countries and its allies starting their record production cuts. Saudi Arabia is going further as it urgently tries to stabilize the market as rock-bottom prices have forced it to impose deep spending cuts.

The kingdom aims to pump just under 7.5 million barrels a day in June, compared with an official target of about 8.5 million a day. Kuwait and the U.A.E. also plan additional daily curbs of 80,000 barrels and 100,000, respectively.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein