By Liam Denning

This captures the current state of the oil market to a tee.

We are a month or so on from the existential angst of negative crude oil futures, and while optimism hasn’t quite flooded back in, the market is definitely chirpier. That’s mostly due to falling supply. April’s price plunge was due to oil production not being able to switch off as quickly as demand did in response to Covid-19. This month, however, OPEC+ production cuts kicked in. The cream, however, is what looks like a much faster drop in shale output than expected, as companies not only idle fracking crews but also shut in wells.

Supply is only one half of the recovery equation, though. Pushing in fewer barrels at one end of the pipe is a must, but the oil glut only clears if more ultimately flows out the other end into cars, trucks, planes and the rest. On demand, it’s clear we’re on the road to recovery, but the map’s offline and the ETA is unknown. Before China put off giving a GDP forecast, the data on traffic there were encouraging for oil bulls, with congestion in some cities now actually higher, year over year. Globally, too, traffic is creeping back up, although it remains about 20%-40% below year-ago levels in most regions, according to estimates released Friday by Rystad Energy, a consultancy.

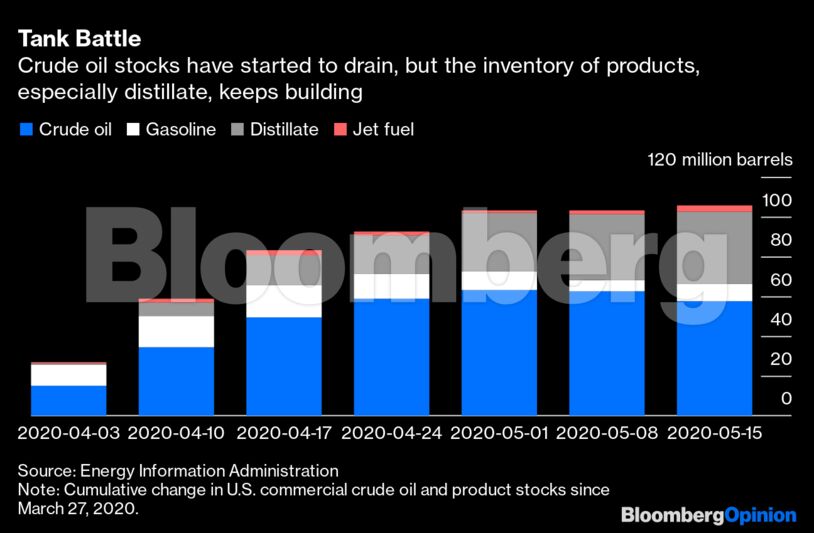

America’s oil inventories tell the story. The latest data, for the week ending May 15, gave with one hand and took with the other. Crude oil stocks, excluding the Strategic Petroleum Reserve, fell by almost five million barrels, and the bulls certainly like that. But crude oil is essentially useless; it has to be refined into products. And stocks of three big ones — gasoline, distillate and jet fuel — increased by more than five million barrels. Gasoline, oil’s official sponsor of Memorial Day, actually snapped a streak of declines with an unexpected increase, despite refineries producing less of it.

This makes sense. Refiners have been buying crude oil at low prices in anticipation of demand recovering; the upward slope in futures makes it economic to store barrels. That demand, combined with supply cuts, has helped to push crude prices back up.

However, those higher crude prices ding refining margins. The spread between gasoline and crude oil prices right now is around $10.50 a barrel, less than half the average for the Friday before Memorial Day over the past five years. Ultimately, for May’s recovery to continue gaining strength, those margins have to improve, or refiners will ease off buying more barrels. That might cap the increase in stocks of refined products, but we would be back to crude oil inventories increasing again, all else equal.

It’s worth pausing on the fact that virtually all of this week’s rally in crude prices took place on Monday, when Moderna Inc.’s release of ultra-preliminary vaccine testing data touched off a buying frenzy in virtually everything other than Treasuries. Like most of us, the oil market yearns for a return to normality and, at this point, is apt to lose it at the first hopeful sign. If cutting supply helps, then demand must ultimately provide the cure. Producers are doing their part (and long-dated prices are telling them to stick with it). Now, drivers, it’s over to you.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire