By Simon Kennedy

(Bloomberg Markets)

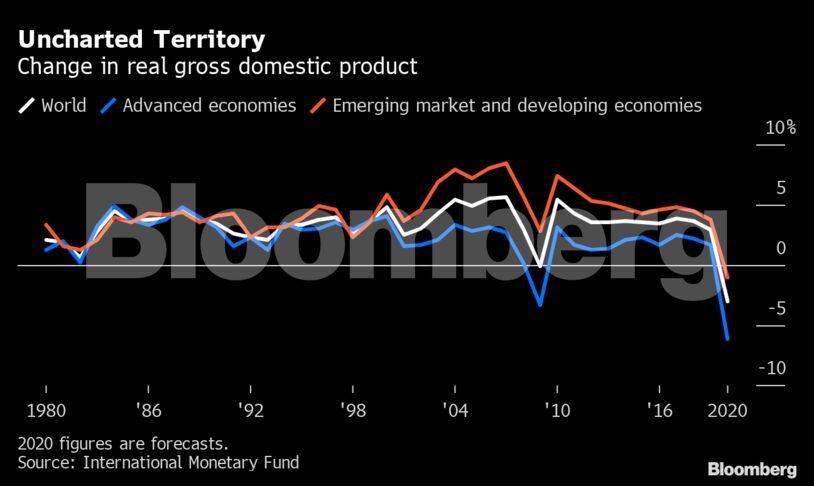

And yet a little more than a decade later, we’re experiencing what appears to be a one-of-a-kind crisis. The Covid-19 pandemic has catapulted the world into its deepest recession since the Great Depression, provoking an unprecedented fiscal and monetary response. The International Monetary Fund is already warning that the outlook has deteriorated since it predicted in April that the world economy would shrink 3% this year. To figure out what might be next, Bloomberg Markets spoke to Reinhart, a former deputy director at the IMF who’s now a professor at the Harvard Kennedy School, and Rogoff, a former IMF chief economist who’s now a professor at Harvard. It turns out this time really is different.

BLOOMBERG MARKETS: How are you faring during the lockdown?

CARMEN REINHART: My husband and I are among the lucky ones because we can work from home. We came to Florida, where we’ve had a house for a decade. Our son lives in this area. Vincent’s brother lives in this area. So we wanted to be close to family. It’s a very busy period even though you’re always at home.

KENNETH ROGOFF: I’m with my wife and 21-year-old daughter in our house in Cambridge, quarantining, so to speak. It’s been a very intense period partly because I was teaching a lot. And there was the shift to Zoom, which created more work because you’re trying to prepare differently and do your lectures differently. It’s obviously a surreal experience overall.

BM: I will start with the clichéd question. Is this time different?

CR: Yes. Obviously there are a lot of references to the influenza pandemic of 1918, which, of course, was the deadliest with estimated worldwide deaths around 50 million—maybe, by some estimates, as many as 100 million. So pandemics are not new. But the policy response to pandemics that we’re seeing is definitely new. If you look at the year 1918, when deaths in the U.S. during the Spanish influenza pandemic peaked, that’s 675,000. Real GDP that year grew 9%. So the dominant economic model at the time was war production. You really can’t use that experience as any template for this. That’s one difference.

It’s certainly different from prior pandemics in terms of the economy, the policy response, the shutdown. The other thing that I like to highlight that is very different is how sudden this has been. If you look at U.S. unemployment claims in six weeks, we’ve had [job losses that] took 60 weeks in terms of the run-up. If you look at capital flows to emerging markets, the same story. The reversal in capital flows in the four weeks ending in March matched the decline during the [2008-09] global financial crisis, which took a year. So the abruptness and the widespread shutdowns we had not seen before.

KR: Certainly the global nature of it is different and this highlights the speed. We have the first global recession crisis really since the Great Depression. In 2008 it was the rich countries and not the emerging markets. They [the emerging markets] had a “good” crisis in 2008, but they’re not going to this time, regardless of how the virus hits them.

The policy response is also different. Think about China. Can you imagine if this had hit 50 years ago? Can you imagine the Chinese state having the capacity to shut down Hubei province? To feed nearly 60 million people, give them food and water and concentrate medical attention? So there is a policy option that we have and I think most countries have. It’s the choice that had to be taken to try to protect ourselves. Obviously, this has been done to differing degrees of effectiveness in different countries, with Asia reacting much quicker and with much better near-term outcomes than Europe and the U.S.

BM: How do you regard the economic policy response?

KR: It’s a little bit as if you were in a war and saying, “I’m not going to grade how you’re doing on the battlefield. I’m just going to grade how you’re hiring extra workers at home.” Obviously how you’re doing on the battlefield is driving everything.

The economic policy response has been massive and absolutely necessary. You can quibble between the European style of trying to preserve firms and workers in their current jobs and the U.S. version, which is to try to address it as a natural catastrophe and try to subsidize people but allow higher unemployment. They’re actually not that different. If this thing persists, a lot of those European firms will end up having to let their workers go when the crisis passes. Some of the U.S. firms will end up rehiring their workers. But certainly the aggressive crisis response reflects lessons learned in 2008.

BM: Does that explain the stock market surge, which seems at odds with the state of the economy?

CR: How much of the resilience, if not ebullience, in the market is policy driven? I think a lot of it. Let’s take monetary policy before the pandemic. U.S. unemployment was at its lowest level since the 1960s. By most metrics the U.S. was at or near full employment. It’s very possible that the path was toward rising interest rates. Clearly that has been completely replaced by a view that rates are zero now and that they’re going to stay low for a very long, long, indeterminate period of time, with a lot of liquidity support from the Federal Reserve. So that’s a big game changer, discounting futures.

Let me just point out another issue in terms of the policy response. The Fed has established a lot of facilities that are now providing support not only to corporates, but to the fallen angels, the riskier corporates that certainly were not envisioned at the outset of the pandemic. What this does mean is that the market is really counting on a lot of rescues. The blanket coverage by the Fed is broad, and that is driving the market. And expectations are that we’re going to have this nice V-shaped recovery and life is going to return to normal as we knew it before the pandemic. And my own view is that neither of those are likely to be true. The recovery is unlikely to be V-shaped, and we’re unlikely to return to the pre-pandemic world. Although I do think that that’s part of the reason why we see this incongruence between the economic numbers and what the market is doing.

KR: Of course, the “Fed lower forever” is part of it. I also feel the markets have a very sanguine view of the virus and what’s going to happen and how quickly we can return to normal or maybe how quickly we will choose to return to whatever normal is. It seems very uncertain to me. I don’t know how we’re coming back to 2019 levels [in the economy] in any near term. The true fall in GDP, economic historians will debate for years. It’s probably much larger than the measured fall. It’s not just the people not working. What’s the efficiency of the people who are working? The monetary response has been done hand in hand with the Treasury. The market is banking on this V-shaped recovery. But a lot of the firms aren’t coming back. I think we’re going to see a lot of work for bankruptcy lawyers going across a lot of industries.

BM: So what does the economic recovery look like?

CR: There is talk on whether it’s going to be a W-shape if there’s a second wave and so on. That’s a very real possibility given past pandemics and if there’s no vaccine. One thing that’s clear is the numbers are going to look spectacularly great in some months simply because you’re coming out from a base that was pretty devastated. That doesn’t imply that per capita incomes are going to go back in V-shape to what they were before.

The shock has disrupted supply chains globally and trade big-time. The World Trade Organization tells you trade can decline anywhere between 13% and 32%. I don’t think you just break and re-create supply chains at the drop of a hat. There are a lot of geographic changes that are being necessitated because, if the economic downturn has been synchronous, the disease itself hasn’t been synchronous.

Another reason I think the V-shape story is dubious is that we’re all living in economies that have a hugely important service component. How do we know which retailers are going to come back? Which restaurants are going to come back? Cinemas? When this crisis began to morph from a medical problem into a financial crisis, then it was clear we were going to have more hysteresis, longer-lived effects.

KR: In our book, Carmen and I use the definition of recovery as going back to the same income as the beginning. That, by the way, is really not the Wall Street definition of recovery, where recovery is going back to where the trend was. So we use a much more modest version of recovery. And still, with postwar financial crises before 2008-09, the average was four years, and for the Great Depression, 10 years. And there are many ways this feels more like the Great Depression.

And you want to talk about a negative productivity shock, too. The biggest positive productivity shock we’ve had over the last 40 years has been globalization together with technology. And I think if you take away the globalization, you probably take away some of the technology. So that affects not just trade, but movements and people. And then there are the socio-political ramifications. I liken the incident we’re in to The Wizard of Oz, where Dorothy got sucked up in the tornado with her house, and it’s spinning around, and you don’t know where it will come down. That’s where our social, political, economic system is at the moment. There’s a lot of uncertainty, and it’s probably not in the pro-growth direction.

Also you probably need a debt moratorium that’s fairly widespread for emerging markets and developing economies. As an analogy, the IMF or Chapter 11 bankruptcy is very good at dealing with a couple of countries or a couple of firms at a time. But just as the hospitals can’t handle all the Covid-19 patients showing up in the same week, neither can our bankruptcy system and neither can the international financial institutions.

So there are going to be phenomenal frictions coming out of this wave of bankruptcies, defaults. It’s probably going to be, at best, a U-shaped recovery. And I don’t know how long it’s going to take us to get back to the 2019 per capita GDP. I would say, looking at it now, five years would seem like a good outcome out of this.

BM: I’d like to focus on the debt issue. The Group of 20 has already agreed to freeze bilateral government loan repayments for low-income nations until the end of 2020. How else do we deal with what developing and emerging economies owe?

CR: The problem in emerging markets goes beyond the poorest countries. For many emerging markets, we’ve also had a massive, massive oil shock. Nigeria, Ecuador, Colombia, Mexico—they’ve all been downgraded. So the hit to emerging markets is just very broad. Nigeria is in terrible shape. South Africa is in terrible shape. Turkey is in terrible shape. Ecuador already is in default status, as well as Argentina. These are big emerging markets. It’s going to be enormously costly.

For the G-20 initiative, I indeed hope it is the G-20 and not just the G-19. China needs to be on board with debt relief. That’s a big issue. The largest official creditor by far is China. If China is not fully on board on granting debt relief, then the initiative is going to offer little or no relief. If the savings are just going to be used to repay debts to China, well, that would be a tragedy.

We’ve not mentioned Italy, and that brings us to the euro zone. This is very, very destructive within the euro zone. If it drags on, the forces that are pulling the euro zone apart are going to grow stronger and stronger.

BM: What is the appetite at the IMF for coming to the rescue?

KR: The IMF at this point is all-in on trying to find a debt moratorium, recognizing there’s going to be restructuring in a lot of places. But I don’t think the U.S. is by any means all-in, and a lot of the contracts of the private sector are governed under U.S. law. And if the U.S. government is not in, if China’s not in, it’s not really enough. But it’s far easier to go the route of the G-20. If the G-20 says it’s in the global interest that debt moratoria be widely respected by all creditors for the next year, then that carries a lot of force, even in U.S. courts. But if they don’t say that, and every country’s left on its own to work something out, I think we get back to my Covid-19 hospital analogy where the system just gets overwhelmed.

BM: What about the debts in the major economies, given they have been run up so aggressively?

KR: It’s not a free lunch, but there was no choice. This is like war. There is no debate that they should be doing all they can to try to maintain political and social cohesion, to maintain economies. But what lies at the other end? I go back to my Wizard of Oz analogy. The financial markets think there’s no chance interest rates will go up. There is no chance inflation will go up. If they’re right, and if another shoe doesn’t drop, it’ll be fine. But we could have costs from this. We’re talking about economies shrinking by 25% to 30%. And those [declines] are just staggering compared to the debt burden costs, whatever they are. So certainly we would strongly endorse doing what governments are doing. But selling it as a free lunch, that’s stupefyingly naive.

CR: I actually wanted to go back to the Italy issue. If you look back to 2008-09, nearly everybody had a banking crisis. But a couple of years later, the focus had moved from the banking problem to the debt problem. And it was the peripheral Europe debt problem with Portugal, Ireland, Iceland—most notoriously Greece—having the largest, by a huge margin, IMF programs in history. I would point out that Greece, Ireland, and Portugal combined are a little over a third of Italian GDP. And if there’s a shakeout that involves concerns about Italy’s growth, then we could have a transition again from the focus on the Covid-19 crisis this time to a debt crisis. But Italy, as I said, is on a different scale than the peripheral countries that got into the biggest trouble in the last crisis. It potentially also envelops Spain. So I think that if you were to ask me about an advanced economy debt issue, I think that is where it is most at the forefront.

KR: We argued at the time that the right recipe was to involve writedowns of the southern European debts. And I think that would have been cheap money in terms of restoring growth in the euro zone and would have [been] paid back. And we may be at that same juncture in another couple of years where you’re looking at just staggering austerity in Spain and Italy on top of a period of staggering hardship. Advanced countries have done this all the time—finding some sort of debt restructuring or writedown to give them fiscal space again, to support growth again. If the euro zone doesn’t find a way to deal with this, maybe eurobonds might be in the picture to try to indirectly provide support. Again, we’re going to see huge forces pulling apart the euro zone.

BM: What about China, which also has leverage challenges?

CR: Chinese growth has always been very outward-looking, very propelled by export-led growth. You’ve also had much of its double-digit growth come from incredible fixed investment. So I think the settling point for Chinese growth is going to be well below 6%. I’m not saying they’re not going to have a rebound after the more than 20% crash at the beginning of this year. But I’m saying that then your settling point is going to be lower than 6%. And part of the story is debt. It’s hard to say in China what is public and what is private, but corporates in China levered up significantly, expecting that they were going to continue to grow at double digits forever. That hasn’t materialized. There’s overcapacity in a lot of industries.

China came into this with inflation running over 5% because of the huge spike in pork prices. So I think initially that the PBOC [People’s Bank of China] has been somewhat constrained initially in doing their usual big credit stimulus by uncertainty over their inflation. I think that’s changing because of the collapse in oil price. So I do think we are going to see more stimulus from China.

KR: There will be a pretty sustained growth slowdown in China. We were on track for that anyway. But who can they export to? The rest of the world is going to be in recession. I think if they can average 1% growth the next two, three years, then that will look good. That’s not a bad prediction for China. And let’s remember, their population dynamic is completely changing. So 3% growth in that, with that Europeanizing of their population dynamics, would not be bad at all. But there’s a big-picture question about their huge centralization, which is clearly an advantage in dealing with the national crisis but maybe doesn’t provide the flexibility over the long term to get the dynamism that at least you’ve got in the U.S. economy.

BM: How does central banking change worldwide? Do we see that blurring of lines with fiscal policy?

KR: It’s fiscal policy that they’re doing in this emergency situation. You can’t imagine trying to get these same subsidies passed through the Senate and the House in real time. So central banks all over the world are using the fiscal side of their balance sheet. A lot of people don’t properly understand that governments own the central banks. And when the central bank uses its balance sheet, it’s acting as an agent on behalf of the government, whether it’s doing maturity transformation, which is what pure quantitative easing is, when it buys long-term debt, [or] it’s doing subsidies to the private sector by buying mortgages, by intervening in corporate debt, by intervening in municipals.

Ultimately I hope we don’t see a big change in central banks, but we’re probably going to need an expansion in finance ministries to take on and regularize and legitimize some of these responsibilities. Lastly I think we’re not in a position to use deeply negative interest rates because the preparation hasn’t been done. And you have to deal with cash hoarding. That’s a shame because I think that would have been a valuable instrument, and would have been helpful for some municipals and corporates, and would have reduced the number of patients going into bankruptcy court. Monetary policy is essentially castrated by the zero bound.

CR: Central banks were the arm of financing during two world wars, without question. I think you would have been laughed at if you really brought up the issue of central bank independence in the context of either world war. You really can’t separate the fiscal story and the debt story from the monetary story in extreme periods. Central banks began to do fiscal policy not just this time around, but they began to do fiscal policy in the 2008-09 crisis. We really can’t look independently at central banks without also looking at the balance sheet, not just of the government, but the balance sheet of the private sector, which has a lot of contingent liabilities.

On the issue of negative interest rates, I do not share Ken’s views on that particular matter. When you have, as we do today, very fragmented markets, markets that became totally illiquid, I think the way I would deal with that would not be through making rates more negative, but by an approach closer to the one taken by the Fed, which is through a variety of facilities that provide directed credit. Sustained negative interest rates in Europe have led to a lot of bank disintermediation. And often bank disintermediation means that you end up with the less regulated, less desirable financial institutions.

BM: There is some question over the future path of inflation. Do you see an inflationary surge at some point?

KR: We don’t know where we will come out. So the probability is, for the foreseeable future, we’ll have deflation. But at the end of this, I think we’re going to have experienced an extremely negative productivity shock with deglobalization. In terms of growth and productivity, they will be lasting negative shocks, and demand may come back. And then you have the many forces that have led to very low inflation maybe going into reverse, either because of deglobalization or because workers will strengthen their rights. The market sees essentially zero chance of ever having inflation again. And I think that’s very wrong.

BM: And what scars are left on economies once the pandemic passes?

CR: Some of the scars are on supply chains. I don’t think we’ll return to their precrisis normal. We’re going to see a lot of risk aversion. We’ll be more inward-looking, self-sufficient in medical supplies, self-sufficient in food. If you look at some of the legacies of the big crises, those have all seen fixed investment ratchet down and often stay down.

Kennedy is executive editor for Bloomberg Economics in London.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein