By Dan Murtaugh

While May futures have declined about 16% to $15.43 a barrel on Monday, June crude is down around 5% to $23.76. Volumes are also larger for June as investors position for the change of contracts. The tens of billions of dollars traded every day in WTI futures are almost always settled financially, but any contract that hasn’t been closed out after expiry has to be liquidated with a physical delivery of oil if the parties can’t come to some kind of over-the-counter agreement. Those deliveries go to the storage hub of Cushing, Oklahoma, which is connected by pipeline to Canada, the U.S. Midwest, West Texas and the Gulf Coast.

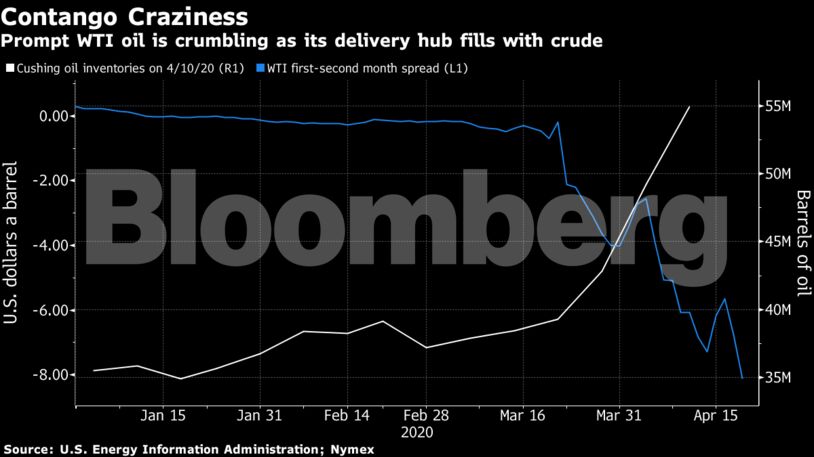

The problem is that Cushing is rapidly filling as fuel consumption collapses due to lockdowns to stem the coronavirus pandemic. Crude stockpiles ballooned by almost 16 million barrels in the three weeks through April 10 to 55 million barrels. The hub had working storage capacity of 76 million as of Sept. 30, according to the Energy Information Administration.

That’s bad news if you’re long May futures, because if you don’t close out your position by the end of trading Tuesday, you have just a few days to let the seller know how you’re going to accept delivery, which is due from May 1-31. At the rate Cushing is filling, finding space is going to be difficult, especially for financial traders who rarely deal with the physical world.

That’s why the May contract for WTI is trading about $8 a barrel lower than the June contract, near the record $8.49 spread between the first- and second-month contracts set in December 2008.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet