By Sharon Cho and Alex Longley

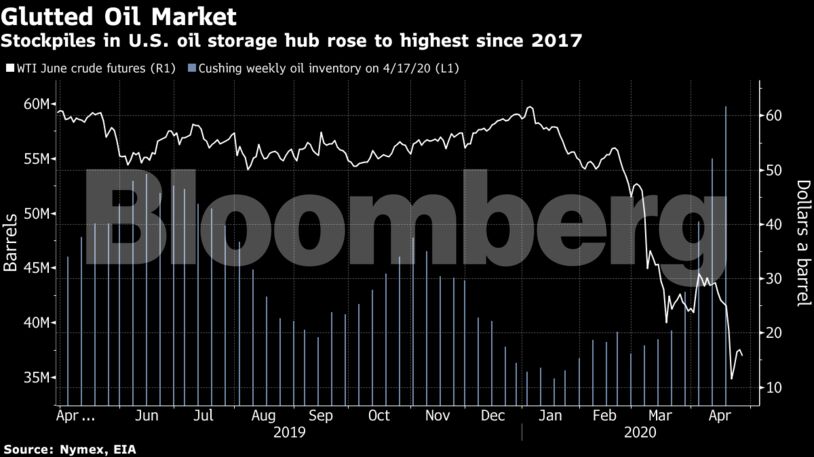

Futures in New York slid as much as 24%, snapping a four-day gain. While U.S. drilling is sliding and Saudi Arabia has started reducing output ahead of the start date for OPEC+ supply cuts, an immense glut of oil means storage tanks are close to capacity around the world. South Korea, which holds the fourth-biggest commercial storage capacity in Asia, was said to run out of onshore stockpiling space.

With a number of producers commencing output cuts, some of the huge discounts seen in physical markets have eased, particularly in Europe. Swaps markets in the North Sea and Russia were trading stronger last week, though there’s still plenty of cause for pessimism. On a global level the swelling glut is set to test storage capacity limits in as little as three weeks, according to Goldman Sachs Group Inc., with traders, refiners and infrastructure providers seeking novel ways to hoard crude, including on tiny barges around Europe’s petroleum-trading hub and in pipelines.

“After a turbulent week the market might have found the bottom, but prolonged price strength is not expected until global demand significantly improves,” said PVM Oil Associates analyst Tamas Varga. “These curtailments, as supportive as they sound, are already part of the supply-demand equation and are built in the price.”

There were tentative signs at the weekend that the coronavirus outbreak might be loosening its grip, with the death tolls slowing by the most in more than a month in Spain, Italy and France. Reported fatalities in the U.K. and New York were the lowest since the end of March.

| Prices |

|---|

|

Saudi Aramco last week began curtailing daily output from about 12 million barrels to 8.5 million, according to a Saudi industry official familiar with the matter. OPEC+ has agreed to reduce production by about 9.7 million barrels a day in an effort to stem oil-price losses.

In a sign that investors are fleeing the volatility at the front of the curve, holdings of June WTI fell by almost 40% last week. On Friday, the U.S. Oil Fund ETF said it is under regulatory pressure because of the size of some of its futures positions

“The shift of open interest away from June, should it pursue, will have negative consequences for the liquidity of the contract, potentially leading in our view to greater volatility in its price.,” said BNP Paribas head of commodities strategy Harry Tchilinguirian.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire