By Alex Longley and Sheela Tobben

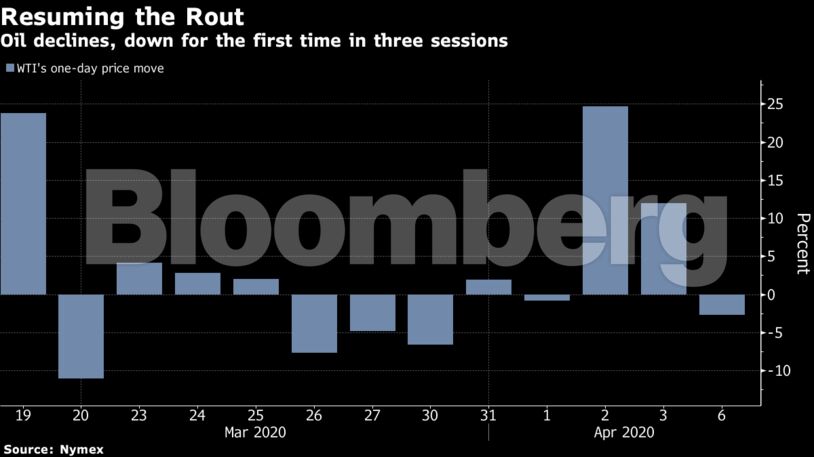

Futures were trading 6% lower in New York Monday, having earlier plunged as much as 11%. Industry data provider Genscape Inc. reported a 5.8 million barrel rise in crude inventories in Cushing, Oklahoma, last week. This would be the largest weekly build at the hub in data going back to 2004 if the U.S. Energy Information Administration confirms this stock gain on Wednesday. Prices previously pared losses on news that large oil-producing nations are racing to negotiate a deal to stem the price crash.

The report on Cushing weakened the prompt WTI futures time-spread. The May contract fell to a session low $3.69 a barrel below June.

“The leg lower was likely the vendor storage release,” said Ryan Fitzmaurice, commodities strategist at Rabobank. But crude oil is still well off the lows of the overnight session, he said, referring to the earlier price dive.

The market is looking forward to a tentative Thursday meeting where large oil-producing nations are expected to negotiate a deal to stem the price crash. Russia and Saudi Arabia want the U.S. to join in, and America’s energy secretary said he had a “productive discussion” with his Saudi counterpart over the weekend about the instability in oil markets.

“Momentum is building for a supply deal to be reached between the Saudis and Russia that will likely involve unprecedented cooperation between OPEC and non-OPEC oil producers,” Fitzmaurice said. “The bar is currently set high at 15 million barrels a day and oil prices risk giving back all if not more of the recent gains if no consensus is reached this Thursday.”

As crude futures fluctuate, the market for real barrels shows renewed weakness, trading several dollars below headline prices. Sellers from Russia to Congo are slashing prices in an effort to sell cargoes. At the same time, gasoline — a premium product in normal times — is currently unprofitable in Europe and barely profitable in America.

| Prices: |

|---|

|

Riyadh and Moscow are “very close” to an agreement on cuts, CNBC reported Monday, citing the head of Russia’s sovereign wealth fund. Still, a lack of participation from the U.S. — the world’s largest producer — could prove to be a stumbling block. Despite originally calling for a deal, Trump on Saturday described OPEC as a cartel and threatened tariffs on foreign oil.

Meanwhile, Saudi Aramco has delayed the release of its closely watched monthly oil-pricing list until Thursday to await the outcome of OPEC+ negotiations, according to people with knowledge of the situation. The U.A.E. signaled the same move on Monday, while also indicating that it had sharply increased production so far this month.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso